UK Residential Property - Prime Central London Rental Index

PRIME CENTRAL LONDON LETTINGS MARKET POISED FOR A PICK-UP IN ACTIVITY

Despite a restrained market since Easter, activity is likely to increase this summer following the election result and positive economic data, says Tom Bill

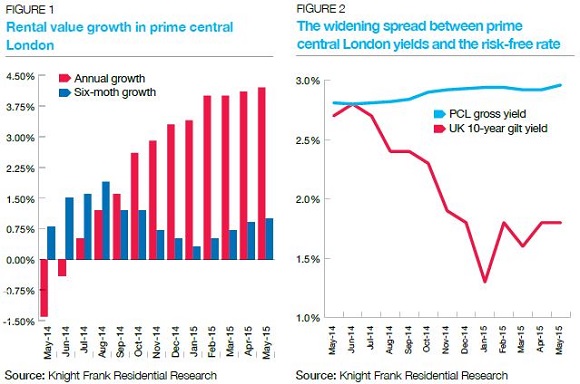

- Annual rental growth rose to 4.2% in May, the highest rate since December 2011

- Positive economic indicators included record employment rate and bouyant business and professional services sector

- A “stop-start” market in May meant new prospective tenants fell 12% and viewings declined 18% versus the same month last year

- New prospective tenants and viewings increased by 12% and 7% over the last 12 months

- Prime gross rental yields increased to 2.96%

Rental values in prime central London continued to climb in May, and annual growth of 4.2% was the highest figure since December 2011.

It compares to a decline of -1.4% in May 2014 and the positive upwards momentum over the last year has been driven by the recovering UK economy and the transfer of demand from the sales market ahead of last month’s general election.

Last month, the Confederation of British Industry said economic growth had “cranked up several gears” with business and professional services sector having seen the fastest growth in business volumes in more than nine years.

Furthermore, the government said in May that employment was at its highest comparable rate since records began in 1971.

Financial markets also received a boost in May, with more than £50 billion added to the value of companies listed on the London Stock Exchange the day following the general election.

While the prime central London lettings market is operating against this increasingly positive economic backdrop, it hasn’t yet fully hit its stride in 2015.

A mood of hesitation around the election, combined with the two bank holidays, meant activity in May was slower compared to last year in what was a “stop-start” market. The number of new prospective tenants was down 12% in May compared to the same month in 2014, while the number of viewings declined 18%.

In spite of the recent dip, new prospective tenants and viewings in the 12 months to May 2015 are up by 12% and 7%, respectively, and activity is expected to increase over the summer as part of a seasonal trend among students, families and corporate tenants.

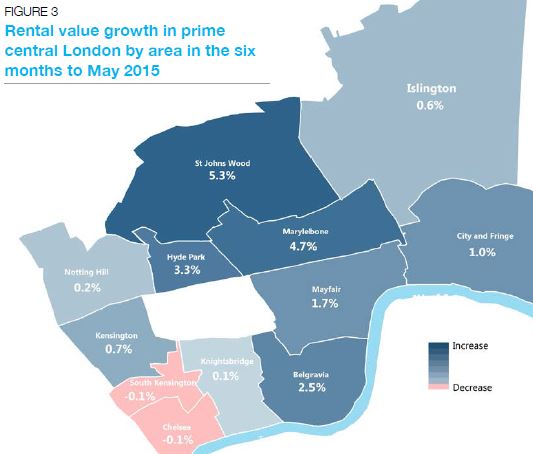

Demand has remained strong in markets including Marylebone and Hyde Park, particularly in lower price brackets, suggesting companies and private renters are still cost conscious despite the improving economy.

Prime gross rental yields edged upwards to 2.96% in May, their highest level since August 2013, widening the spread between the risk-free rate on a 10-year government bond.

Courtesy: Knight Frank

DATA DIGEST

The Knight Frank Prime Central London Index, established in 1976, is the longest running and most comprehensive index covering the prime central London residential marketplace. The index is based on a repeat valuation methodology that tracks capital values of prime central London residential property. ‘Prime central London’ is defined in the index as covering: Belgravia, Chelsea, Hyde Park, Islington, Kensington, Knightsbridge, Marylebone, Mayfair, Notting Hill, South Kensington, St John’s Wood, Riverside* the City and the City Fringe. ‘Prime London’ comprises all areas in prime central London, as well as Barnes, Canary Wharf, Chiswick, Clapham, Fulham, Hampstead, Richmond, Wandsworth, Wapping and Wimbledon.

* Riverside in prime central London covers the Thames riverfront from Battersea Bridge in the west to Tower Bridge in the east, including London’s South Bank. The City Fringe encompasses the half-mile fringe surrounding most of the City including Clerkenwell and Farringdon in the west and Sho editch and Whitechapel in the east

RESIDENTIAL RESEARCH

Tom Bill, Head of London Residential Research

+44 20 7861 1492

PRESS OFFICE

Daisy Ziegler

+44 20 7861 1031

Jamie Obertelli

+44 20 7861 1104

© Knight Frank LLP 2015 - This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.