International Property - Which city tops our European prime residential forecast for 2025?

Written By: Kate Everett-Allen, Knight Frank

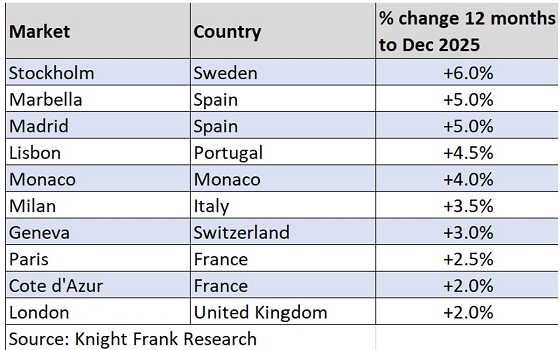

As we look ahead to 2025, the prime residential markets across key European cities and luxury resorts are set to see different levels of price growth although all of the ten markets tracked will register price growth.

Leading the charge is Stockholm, which Knight Frank predicts will see a 6% price growth over the next 12 months.

Having experienced a 13% decline from its June 2022 peak, the Swedish capital is now poised for recovery. The Riksbank’s recent interest rate cuts, four in six months, have slashed the policy rate from 4% to 2.75%, improving market sentiment.

Southern Europe: A post-pandemic oasis

Following Stockholm is the Iberian trio of Marbella (5%), Madrid (5%), and Lisbon (4.5%). These southern European markets are thriving thanks to several factors. The IMF expects the region’s economies to outshine many in the Eurozone, while prime buyers continue to seek lifestyle enhancements post-pandemic. From hybrid work opportunities to sunny climates and top-tier international schools, these destinations are ticking all the right boxes for global investors and relocators.

Monaco: The ultra-wealthy’s safe haven

In fifth place, Monaco is set to achieve 4% price growth in 2025. The city-state’s limited supply underpins its price resilience, while its low-tax environment increasingly attracts ultra-high-net-worth individuals (UHNWIs) as global fiscal pressures push taxes higher elsewhere.

Italy’s rising appeal

Milan secures sixth place with a projected 3.5% growth. The Italian city’s allure lies in its appeal to UHNWIs leveraging Italy’s flat-tax regime. Despite an August increase in the annual levy from €100,000 to €200,000, the market remains robust. Additionally, the upcoming changes to the UK’s non-domicile tax regime in April 2025 could drive more relocation purchases, with many buyers also opting for second homes in the nearby Italian lakes.

Geneva: A safe-haven stronghold

Geneva’s 3% growth forecast reflects its continued status as a safe haven for global elites. With a strong currency, low taxes, and excellent quality of life, the city remains a favourite among UHNWIs. A planned income tax cut in 2025 in the Canton of Geneva will further bolster its appeal.

Paris: Resilience amid turmoil

Despite political instability, Paris is drawing increasing interest from UK and US buyers, driven by a weak euro. Buyers are eager to move forward having put their plans on hold for several years following the 2024 Olympics and France’s general election.

London: Slow but steady recovery

Although London sits at the bottom of the forecast with a projected 2% growth, this would mark its best performance since 2014. According to Knight Frank’s Tom Bill, the UK Budget in October narrowed expectations for prime central London from 3% to 2%. Changes in tax policies for overseas investors and entrepreneurs, coupled with higher stamp duties on second homes, are tempering the city’s recovery.

Europe’s overall outlook

Europe faces notable challenges: sluggish economic growth, political uncertainties in France and Germany, and potential US tariffs. Yet, its transparent property markets, excellent accessibility, high quality of life, and world-class schools will continue to attract global wealth in 2025.

Courtesy: Knight Frank Press

Disclaimer: Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. Important Notice: © Knight Frank LLP 2022 This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.

Categories: Property Sector, Residential Sales, World Regions, Europe, France, Italy, Monaco, Spain, Switzerland