UK Property Taxation - Changes to Stamp Duty in the United Kingdom

Changes to Stamp Duty

Liam Bailey, head of residential research at Knight Frank comments: -

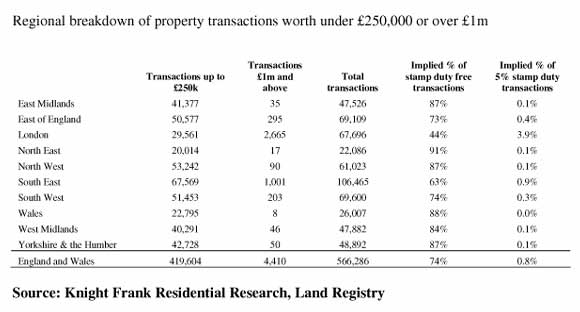

"The changes to Stamp Duty announced today amount to a tax on London – only 44% of property sales will slip under the new zero-rate band compared average of 74% in the rest of the country. In addition well over 60% of all £1m+ transactions affected by the new 5% rate take place in the capital.

"The removal of stamp duty for first-time buyers purchasing properties under £250,000 is a welcome move and will benefit the new-build market that has been particularly hard hit by the housing downturn. Even in London, 44% of the properties sold last year were below £250,000. In some parts of the UK virtually all the housing stock will now be free of stamp duty for first time buyers.

"At the other end of the scale, the decision to increase the rate of stamp duty on properties worth over £1m from 4% to 5% is less welcome, although not entirely unsurprising as there is great public pressure for the perceived rich to pay more tax.

"For the super-rich purchaser the increase will be little more than a minor irritation and we do not expect it to have any impact on the market for houses worth over £3m. For houses worth around £1m there will be pressure from buyers to pull back asking prices below the new threshold to avoid paying the extra stamp duty."

Courtesy: Knight Frank Residential Research

For further information, please contact:

Liam Bailey, Knight Frank head of residential research,

+44 (0) 7919 303 148

Davina MacDonald Lockhart, Knight Frank,

+44 (0) 209 7861 1033,