SA Lending - Mortgage advances growth edging lower again

Mortgage advances growth edging lower again

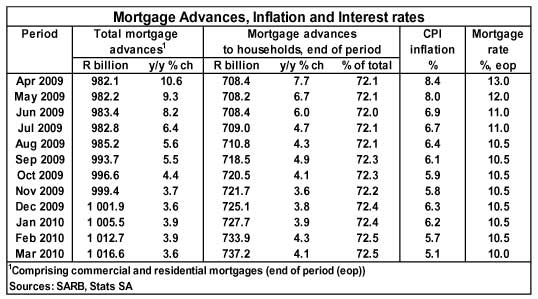

Statistics released by the South African Reserve Bank showed that the year-on-year (y/y) growth in monetary institutions’ total outstanding mortgage balances, comprising commercial and residential mortgage loans, was lower at 3,6% in March 2010 from a level of 3,9% in February. Month-on-month growth was also lower at 0,4% in March (0.7% in February).

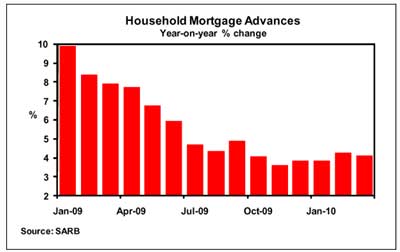

Outstanding mortgage balances with regard to the household sector were up by 4,1% y/y in March, which was slightly lower than the growth rate of 4,3% y/y recorded in February this year. Month-on-month growth of 0,4% was recorded in household sector mortgage balances in March, down from 0,9% in February.

Total credit extended to the household sector, which consists of instalment sales agreements, leasing finance, mortgage advances, overdrafts, credit card debt and other loans and advances, increased marginally to 3,6% (y/y) in March from 3,5% in February. On a monthly basis, household credit extension was up by 0,3% in March (1,1% in February).

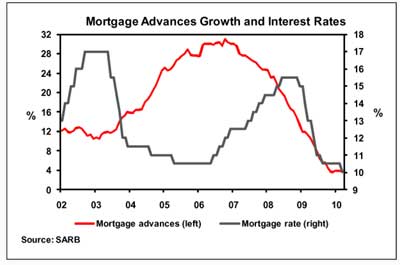

Household mortgage advances, largely related to residential property, continued to record relatively low year-on-year growth over the past few months. This is evident of households’ financial position, which is influenced by factors such as tight labour market conditions, pressure on household disposable income, and a high debt-to income ratio. In addition to this, applicants for mortgage loans have to qualify for finance, based on banks’ lending criteria and National Credit Act stipulations.

Against this background, mortgage advances growth appears to be on a very gradual and slow recovery, but which will be supported by the economic recovery, low interest rates and a revival in property market conditions. In view of these developments and expectations, mortgage advances is still forecast to record single digit growth this year.

Courtesy: Jacques du Toit Senior Economist ABSA Bank

Disclaimer:

The information in this publication is derived from sources which are regarded as accurate and reliable, is of a general nature only, does not constitute advice and may not be applicable to all circumstances. Detailed advice should be obtained in individual cases. No responsibility for any error, omission or loss sustained by any person acting or refraining from acting as a result of this publication is accepted by Absa Group Limited and/or the authors of the material.