Finance Matters - The great risk to a living annuity lies with capital erosion, not return volatility

The great risk to a living annuity lies with capital erosion, not return volatility

Simon Pearse, CEO of Marriott Asset Management, takes a new look at an old problem

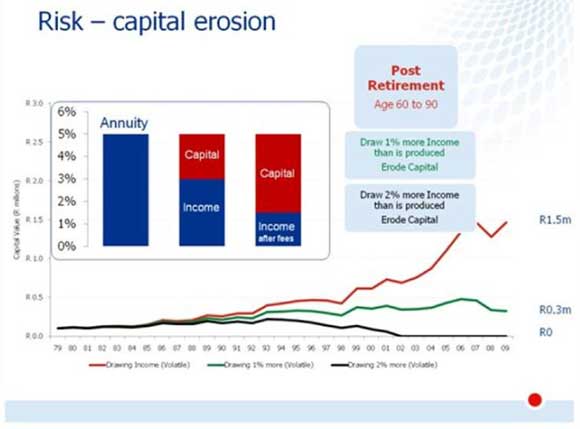

When investing for retirement, age 30 to 60, the aim is to accumulate capital. All investment Income is re-invested, often tax free. The post-retirement phase, age 60 to 90, differs as the investor draws an annuity from the investment. The real threat to the annuity lasting is capital erosion, best described by the level of annuity income exceeding the level of income produced by the selected investment funds. In post retirement planning, the critical drivers are therefore the selection of investment funds that produce a reliable income and the avoidance of capital erosion.

The chart below describes various outcomes from an investment of R100 000 made in 1980 into a balanced fund of 60% equity, 30% bond and 10% cash. A retired investor who drew an annuity that equated to the income yield of the fund, after fees, would have had an average annual return of 9.4% and today the investment would be valued at R1.5m. Had the same investor drawn an annuity of 1% more than the fund produced the value today would be R300 000. An annuity of 2% more would have eroded all the capital within 22 years.

The bar chart represents a typical case of capital erosion. The first blue bar represents an annuity of 5%pa. The second blue bar represents the income yield of 3% that may be expected from a balanced fund. The red represents the annual capital erosion of 1.5%. The third blue bar represents the net yield from the fund after removing annuity fees. The point being made is that the likely capital erosion in many retired investor annuities is likely to be greater than 2%. This is difficult to access as most balanced and equity funds do not publish income yields.

Courtesy: Simon Pearse, CEO of Marriott Asset Management

For more information contact:

Marriott Asset Management:

Bronwen Barclay, Head of Marketing & Distribution: 031 765 0736 or 083 797 9979

Simon Pearse, CEO: 031 765 0700

Shirley Williams Communications

Shirley Williams: 031 564 7700 or 083 303 1663

Gillian Findlay: 082 330 1477

About Marriott Asset Management

Marriott: Income Focused Investing is a differentiated asset management house that offers niche products, predominantly for the retired investor. The tag-line “Income Focused Investing” evolved as a result of the investment philosophy underpinning Marriott Asset Management.

Marriott Asset Management began as Russell & Marriott in Durban in 1862, making it one of the oldest financial services businesses in the country. The company currently has over R8-billion in assets under management, and offers a number of investment products including local and international collective investment schemes. Marriott Asset Management was acquired by Old Mutual in 2005 and now forms part of the Old Mutual Investment Group SA as an independent boutique.