International Property - Prime Scottish Property Index, Q4 2011 Headlines

Prime Scottish Property Index, Q4 2011 Headlines

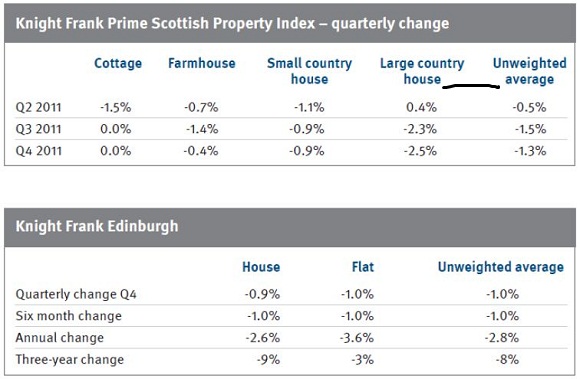

- Scottish prime house prices down 1.3% in Q4 after a 1.5% decline in Q3

- Values are down 3.2% on an annual basis

- Large country houses have fallen in value by 4.3% year on year, while cottages are down 1.5%

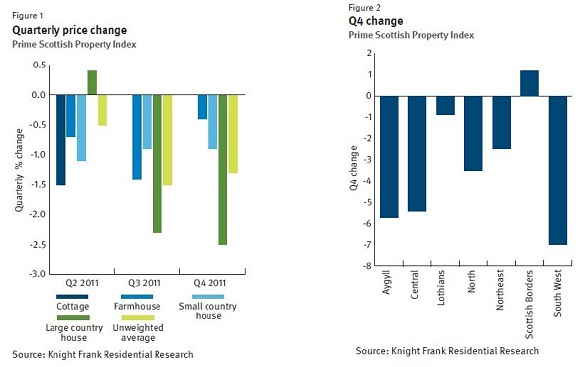

- Prices are still rising in the Scottish Borders, with a 1.2% annual rise, but average values down 7% in the South West

- Stock levels up 10%

- Prices in Edinburgh down 1% in Q4 taking the annual decline to 2.8%

Average prices of country houses outside Edinburgh fell by 1.3% in the final three months of the year, a more modest decline than the 1.5% decline in the third quarter. Average prices are down 3.2% year on year, but this masks some regional variations. Prices in the Scottish Borders have been resilient, rising by 0.2% between October and December, and 1.2% year on year. But the South West of Scotland has suffered larger falls, with prices down 7% year on year.

Ran Morgan, Head of Knight Frank’s Scottish residential department, said: “The prime market is hugely varied in Scotland but in general these figures show how tough market conditions have been in 2011. The further you go from London the more difficult life has been.

“As usual in such tough fiscal conditions, a two tier market develops. The best houses in the best areas continue to fare well. Oil has supported Aberdeenshire with some phenomenal prices paid for town houses in the City. Rural Aberdeenshire within commuting distance of the City has also done well with Midmar Castle being the marker sale of the year at circa £3m.

“Perthshire has also performed relatively well as long as the properties are of quality and well-priced. There has been no shortage of trade within the Central Belt which mainly appeals to domestic buyers but again this is incredibly price sensitive. Fife, Kinross and Stirlingshire have performed better than their commuting cousins south of the Central Belt.

“Large Houses with comparatively little land, outside the commuting areas, have been the worst affected properties in the downturn. Those with land or an ability to run a business have traded satisfactorily. Both in the City and the rural markets we have been unseasonably busy with enquiries and offers during the recent weeks leading up to and including the festive period. This bodes well for 2012.”

Matthew Munro, partner in Knight Frank’s Scottish residential department, adds: “Although values in Edinburgh’s prime residential market are down, activity has been steady throughout the year. The more recognised seasonal trading periods have been replaced by steady and continuous activity throughout the year with an uplift towards the end of the year.

“Overseas buyers in particular are very much in evidence. These buyers clearly see Edinburgh’s prime housing stock as quality and good value. Our offices in Moscow and St. Petersburg have been particularly busy introducing buyers to our office here in Edinburgh.

“Edinburgh’s residential middle market has seen the most resilience and shown genuine signs of improvement in terms of the levels of activity and volume of sales compared to the previous twelve months.

Good quality flats in the New Town and West End between £350,000 and £750,000 and family houses below £1,000,000 in all the recognised residential areas of the city have been in demand with the greatest activity on the south side of the city. Our experience confirms that any property that is professionally marketed and competitively priced will sell successfully.”

Courtesy: Knight Frank and Markit

For further information, please contact:

Grainne Gilmore, Head of UK Residential Research, Knight Frank:

+44(0)20 7861 5102,

[email protected]

Ran Morgan, Head of Scotland Residential, Knight Frank:

+44(0)131 222 9600, +44 (0)7825 681295,

[email protected]

Charlotte Palmer, Country PR Manager, Knight Frank:

+44 (0)20 7861 5037, +44 (0) 7766 775 832,

[email protected]