Uk Property - House prices fall further in April but are expected to recover over coming year

Knight Frank/Markit House Price Sentiment Index (HPSI) – APRIL 2012

House prices fall further in April but are expected to recover over coming year

Key headlines for April

- UK households perceive a decline in value of their homes for the 22nd successive month

- Lower prices recorded in ten out of 11 regions

- …with London bucking the trend

- Year-ahead outlook for house prices remains positive

Change in current house prices

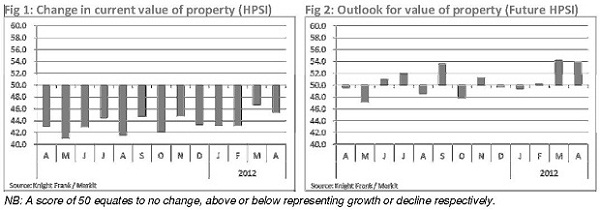

Knight Frank/Markit’s House Price Sentiment Index (HPSI) signalled a further drop in house prices during April. A perceived reduction in home values was reported by 17% of households, versus around 8% indicating a rise. At 45.4, the resulting HPSI figure is down from March’s 20-month high of 46.6.

Any figure under 50 indicates that prices are falling, and the lower the figure, the steeper the decline. Any figure over 50 indicates that prices are rising.

As was the case in March, lower property values were signalled in ten of the 11 regions in April, according to the survey of 1,500 households. Sentiment was weakest in the North East (39.1) and Wales (39.2), which both recorded accelerated price falls. London continued to buck the trend, with those living in the capital reporting that the value of their home had risen for the second month running, albeit at a slower pace than in March (53.6, down from 55.1).

A lead indicator

Since the inception of the HPSI, the index has been a clear lead indicator for house price trends. Figure 3 shows that the index moves ahead of mainstream house price indices, confirming the advantage of an opinion‐based survey which provides a current view on household sentiment, rather than historic evidence from transactions or mortgage market evidence.

Outlook for house prices

The future HPSI (figure 2), which measures what households think will happen to the value of their property over the next year, remained in positive territory for the third consecutive month in April, posting only just below March’s 20-month high. Approximately 29% of households anticipate a rise in the value of their home over the next 12 months, compared with 21% expecting a decline. The resulting index reading is 54.0.

Regional outlook

Positive expectations for house prices were recorded in nine of the 11 regions in April, up from just six in March. Respondents in London remain by far the most upbeat (62.2), followed by those in the South East (56.4) and East Midlands (55.7).

Only in the North East (45.1) and Wales (48.0) are house prices expected to decline.

Household variations

Sentiment regarding future house prices is broadly similar in the private (54.3) and public (55.0) sectors, with the latter recording marginally stronger optimism (the first time this has been the case in two years).

Respondents working in the Media/Culture/ Entertainment sector forecast the sharpest rise in the value of their home (68.5). Expectations are also strong in the IT/Telecoms category (59.2). The weakest sentiment is in the Retail sector (50.1), where survey participants expect house prices to broadly stagnate, although this represents an improvement on the previous six months where price falls were predicted.

Increased house prices over the coming year are forecast by homeowners and renters alike (in addition to those living rent-free at home). Mortgage-holders anticipate the strongest rise (55.3), followed by those renting privately.

Gráinne Gilmore, head of UK residential research at Knight Frank, said: “There is little surprise that outside London, the current view of households regarding the movement of their house price movements remains negative – economic news continues to deliver at best a mixed picture of the fortunes for the economy.

“The more interesting issue is the continuing view that house prices are likely to rise over the next 12 months.

“This confidence about future market movements is a welcome sign for the market – especially the breadth of confidence across the UK, with all but two regions expecting to see price growth in the near future.”

Chris Williamson, chief economist at Markit, said"It's very encouraging to see the recent improvement in sentiment about house prices holding up in April. Views on both current and future prices have fallen back only very slightly from the improvement in March, which saw the most upbeat assessment since mid-2010.

"A healthy housing market is a key ingredient of economic recovery, not only because falling prices reduce homeowners' wealth, lead to negative equity and hit consumer spending, but also because new home sales often stimulate spending on home improvements.

"It is once again London where perceptions about the current and future course of house prices is the most buoyant. However, a narrowing of the north-south divide was apparent: with the exception of Scotland, the northern regions and the midlands saw sentiment about house prices in the coming year improve whereas all southern regions, the east of England and Wales all saw a deterioration."

Courtesy: Knight Frank and Markit

For further information, please contact

Knight Frank

Rosie Cade, PR Manager

[email protected]

020 7861 1068

Gráinne Gilmore, Head of UK Residential Research

[email protected]

020 7861 5102

07785 527 145

Markit

Rachel Harling, Corporate Communications

[email protected]

020 7064 6283

Chris Williamson, Chief Economist

[email protected]

0779 5555061

About the HPSI

The Knight Frank/Markit House Price Sentiment Index (HPSI) survey was first conducted in February 2009 and is compiled each month by Markit.

The survey is based on monthly responses from approximately 1,500 individuals in Great Britain, with data collected by Ipsos MORI from its panel of respondents aged 18-64. The survey sample is structured according to gender, region and age to ensure the survey results accurately reflect the true composition of the population. Results are also weighted to further improve representativeness.

Prior to September 2010, the Household Finance Index was jointly compiled by YouGov and Markit based on monthly responses from over 2,000 UK households, with data collected online by YouGov plc from its representative panel of respondents aged 18 and above. The panel was structured according to income, region and age to ensure the survey results accurately reflected the true composition of the UK population. Results were also weighted to further improve representativeness.

Index numbers

Index numbers are calculated from the percentages of respondents reporting an improvement, no change or decline. These indices vary between 0 and 100 with readings of exactly 50.0 signalling no change on the previous month. Readings above 50.0 signal an increase or improvement; readings below 50.0 signal a decline or deterioration.

Ipsos MORI technical details (April survey)

Ipsos MORI interviewed 1500 adults aged 18-64 across Great Britain from its online panel of respondents. Interviews were conducted online between 12th– 17th April 2012. A representative sample of adults was interviewed with quota controls set by gender, age and region and the resultant survey data weighted to the known GB profile of this audience by gender, age, region and household income. Ipsos MORI was responsible for the fieldwork and data collection only and not responsible for the analysis, reporting or interpretation of the survey results.

About Knight Frank

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank and its New York-based global partner, Newmark Knight Frank, operate from 209 offices, in 47 countries, across six continents. More than 6,840 professionals handle in excess of US$755 billion (£521 billion) worth of commercial, agricultural and residential real estate annually, advising clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit www.knightfrank.com.

For the latest news, views and analysis on the world of prime property visit Knight Frank's new website Global Briefing at http://globalbriefing.knightfrank.com/. And follow us on twitter @kfglobalbrief and @knightfrank.

About Markit

Markit is a leading, global financial information services company with over 2,000 employees. The company provides independent data, valuations and trade processing across all asset classes in order to enhance transparency, reduce risk and improve operational efficiency. Its client base includes the most significant institutional participants in the financial market place. For more information please see www.markit.com

The intellectual property rights to the HPSI provided herein is owned by Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Markit and the Markit logo are registered trade marks of Markit Group Limited.