SA Interest Rates - How can you prepare your clients for a possible turn in the interest rate cycle?

Consumers have had significant relief over the past few years with interest rates being close to their lowest levels in almost 40 years. However, with the first 0.5% increase in interest rates behind us and an expectation of further interest rate hikes to come, it is important for investors to position their portfolios appropriately.

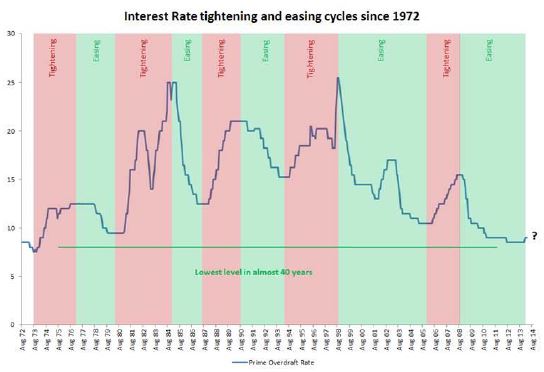

The chart below illustrates the South African interest rate cycles going back to 1972:

The latest easing cycle in South Africa, which began in 2008, coincided with quantitative easing (QE) in first world markets. This form of monetary policy kept bond yields artificially low for a protracted period of time, in the hope of stimulating economic growth. It is widely anticipated that this unusual form of monetary stimulus will come to an end in the latter part of 2014, placing upward pressure on bond yields. This is likely to coincide with interest rate hikes locally. Investors, therefore, need to consider the investment implications of a normalising yield environment.

In its latest report (Global Economic Prospects Report – Jan 2014), the World Bank had the following comments to make regarding a higher yielding environment:

”The tapering of asset purchases by the Federal Reserve is expected to lead to a rise in base interest rates and spreads. A 100-basis point increase in high-income country base rates is likely to be associated with a 110 to 157 basis point increase in developing country yields, implying an increase in the cost of capital, which could lead to lower investment and growth.”

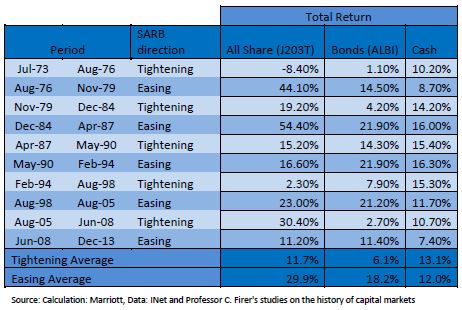

The returns of South African asset classes in both tightening and easing interest rate cycles are highlighted in the table below:

It is clear from this table that markets performed better during periods where interest rates were declining. During tightening cycles, on average, cash fared well relative to other asset classes, while bonds performed the worst. With an expectation of rising bond yields going forward, this trend is set to continue. Given the high correlation between bond and property performance, we would urge investors to exercise caution with fixed interest bonds and listed property, at this point in the interest rate cycle.

Consumers are expected to face continuing pressure as interest rates increase and this will be exacerbated by the fact that consumer confidence is close to its lowest level in almost 10 years (according to the FNB/BER Consumer Confidence Index).

With the consumer under pressure, earnings growth from companies in South Africa will be subdued. Given this outlook, combined with demanding valuations, it suggests that investors need to reduce their return expectations for local equities in the years ahead.

To ensure an acceptable investment outcome in a tightening interest rate environment, Marriott suggests that investors:

- Minimise exposure to fixed interest bonds and listed property.

- Invest in companies that offer basic necessities, such as food, telecommunication and healthcare. These businesses are defensive and will be able to grow their earnings, regardless of a consumer slowdown.

- Consider some exposure to first world equity markets, where valuations are attractive and investors could find diversification benefits.

This release has been issued on behalf of Marriott, the Income Specialists

For more information, please contact:

Marriott:

Tamryn Kelley, Marriott Marketing

031 765 0766 (direct)

031 765 0700 (switchboard)

Shirley Williams Communications:

Shirley Williams: 031 564 7700 or 083 303 1663

Gillian Findlay: 082 330 1477

About Marriott, the Income Specialists

Marriott aims to reduce financial anxiety of retired investors by offering Solutions for Retirement, using an Income Focused Investment Style which produces reliable and consistent monthly income.