House Price Indices - South African House Price Growth Improving

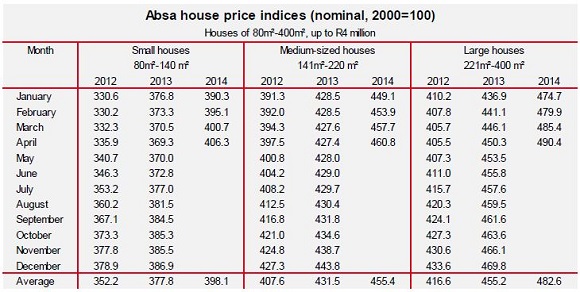

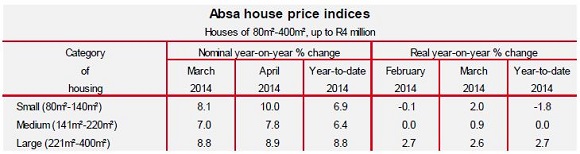

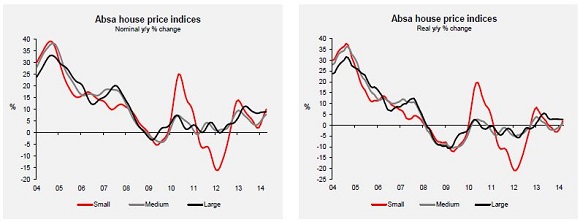

Nominal year-on-year growth in the average value of homes in the middle segment of the South African housing market has improved in recent months up to April. Base effects remain a prominent factor in the latest trends in price growth. Real house price growth, i.e. after adjustment for the effect of consumer price inflation, continued to vary between some deflation and some positive growth in the segments in the first three months of the year compared with the corresponding period a year ago. These price trends are according to the Absa house price indices, which are based on applications for mortgage finance received and approved by the bank in respect of middle-segment small, medium-sized and large homes (see explanatory notes).

The average nominal value of homes in each category was as follows in April 2014:

- Small homes (80m²-140m²): R809 200

- Medium-sized homes (141m²-220 m²): R1 151 300

- Large homes (221m²-400m²): R1 786 100

The consumer sector continues to experience financial pressure against the background of rising consumer price inflation, higher interest rates, relatively high levels of debt, declining real disposable income growth, low savings and depressed labour market conditions. These developments, together with a low level of consumer confidence, contributed to growth in household credit balances to slow down to just 4,8% y/y at the end of March. The growth in the value of household mortgage balances tapered off to only 2,3% y/y by the end of March this year.

Consumer price inflation is currently largely driven by factors such as accelerating food prices, high transport costs, exchange rate movements and wage hikes. The headline inflation rate came in at 6% year-on-year (y/y) in March, up from 5,8% y/y in January and 5,9% y/y in February, after a recent low of 5,3% y/y in November last year. Inflation is forecast to average above the 6% level in 2014, with interest rates expected to rise further on the back of economic developments and the outlook for inflation. These trends will add to consumers’ financial strain.

Trends in and prospects for the economy, household sector finances and consumer confidence are expected to be reflected in the performance of the residential property market, with single-digit nominal house price growth forecast for 2014. Little real house price growth is projected for the year, based on the combined effect of expected trends in nominal price growth and consumer price inflation.

Courtesy: ABSA Bank

![]()

Compiled by: Jacques du Toit Property Analyst

Absa Home Loans

45 Mooi Street

Johannesburg | 2001

PO Box 7735

Johannesburg | 2000

South Africa

Tel +27 (0)11 350 7246

www.absa.co.za

Explanatory notes:

The Absa house price indices, available back to 1966, are based on the total purchase price of houses in the 80m²-400m² size category, priced at R4 million or less in 2014 (including improvements), in respect of which mortgage loan applications were received and approved by Absa. Prices are seasonally adjusted and smoothed in an attempt to exclude the distorting effect of seasonal factors and outliers in the data. As a result, the most recent index values and price data may differ from previously published figures.

The information in this publication is derived from sources which are regarded as accurate and reliable, is of a general nature only, does not constitute advice and may not be applicable to all circumstances. Detailed advice should be obtained in individual cases. No responsibility for any error, omission or loss sustained by any person acting or refraining from acting as a result of this publication is accepted by Absa Bank Limited and/or the authors of the material.