Residential Research - Prime Global Rental Index

Results for Q1 2014

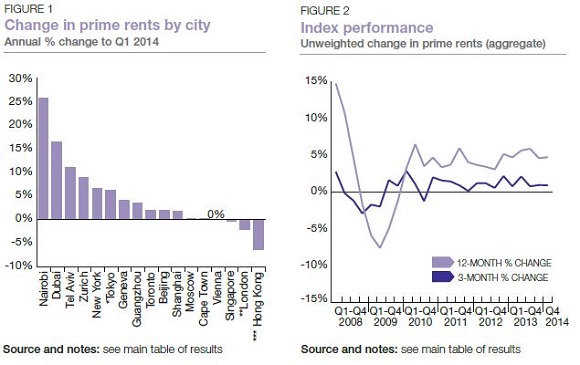

- The index rose by 4.7% in the year to March 2014

- Nairobi topped the annual rankings for the fourth consecutive quarter

- Prime rents declined in Singapore, London and Hong Kong in the year to March 2014

- Dubai and Tokyo recorded the strongest rise in prime rents in the first quarter of 2014

- Rising interest rates could push would-be buyers into prime rental markets in cities such as London and New York in 2015

“ The key risks for the world’s sales markets could emerge as catalysts for growth in terms of prime rents.”

Follow Kate at @keverettkf

For the latest news, views and analysis on the world of prime property, visit Global Briefing or @kfglobalbrief

PRIME RESIDENTIAL RENTAL GROWTH WEAKEST IN WORLD’S TOP FINANCIAL CITIES

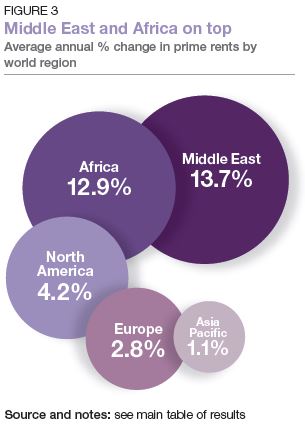

Prime residential rental growth in emerging markets such as Nairobi and Dubai continues to outpace that of the traditional financial centres of London and Hong Kong. Kate Everett-Allen examines the latest index results.

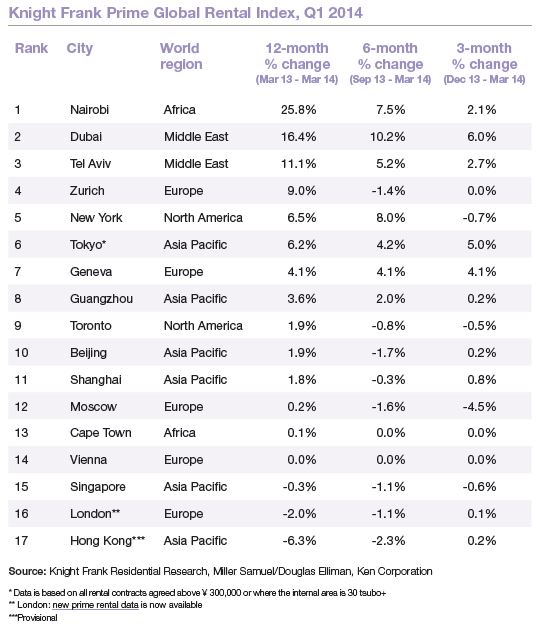

Nairobi leads our annual rankings for the fourth consecutive quarter. Prime rents in the Kenyan capital increased by almost 26% in the year to March, but there are signs the market is cooling with growth of only 2.1% recorded in the first three months of 2014.

Some of the world’s top financial centres – Singapore, London and Hong Kong – are positioned at the bottom of the rankings with annual falls of -0.3%, -2.0% and -6.3% respectively.

However, we expect prime rental growth in these key cities to strengthen over the remainder of 2014.

In London, the rental recovery looks to be taking hold as price growth starts to slow. New registrations are up 17% year-on-year and tenant demand is coming from a diverse set of industries – oil and gas, mining and IT.

In Hong Kong, although there has been a relaxation of the Double Stamp Duty rule, a number of stringent cooling measures remain in place. With foreign buyers facing purchase costs of 25% of the sales price, the luxury rental market is attracting those deterred from buying, which should help support future rental growth.

Dubai and Tokyo recorded the strongest rates of growth with prime rents rising by 6% and 5% respectively in the first three months of the year.

In Dubai, prime rents continue to outpace wage inflation. This is raising concerns about affordability and is leading domestic and expat buyers alike to consider purchasing a home. However, the introduction of a mortgage cap and higher transfer fees at the end of 2013 has led some to defer this decision.

Whilst prime rents around the world rose by 4.7% in the year to March, they were outperformed by prime capital values which increased by 6.1% over the same period. We expect the gap to narrow as corporate tenant demand – a key driver of prime rents – strengthens on the back of improving economic and business sentiment.

The key risks for the world’s sales markets could emerge as catalysts for growth in terms of prime rents.

The withdrawal of stimulus, along with the expected rise in interest rates in influential economies such as the US and the UK, is likely to boost rental demand as mortgage costs rise over time.

DATA DIGEST

The Knight Frank Prime Global Rental Index is an important resource for investors and developers looking to monitor and compare the performance of prime residential rents across key global cities. Prime property corresponds to the top 5% of the mainstream housing market in each city. The index is compiled on a quarterly basis using data from Knight Frank’s network of global offices and research teams.

Courtesy: Knight Frank

RESIDENTIAL RESEARCH

Liam Bailey

Global Head of Research

+44 20 7861 5133

Kate Everett-Allen

International Residential Research

+44 20 7861 1513

PRESS OFFICE

Astrid Etchells

+44 20 7861 1182

© Knight Frank LLP 2014 - This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.