International Investment - The importance of adopting a global mindset when investing today

By Lourens Coetzee, Marriott Asset Management

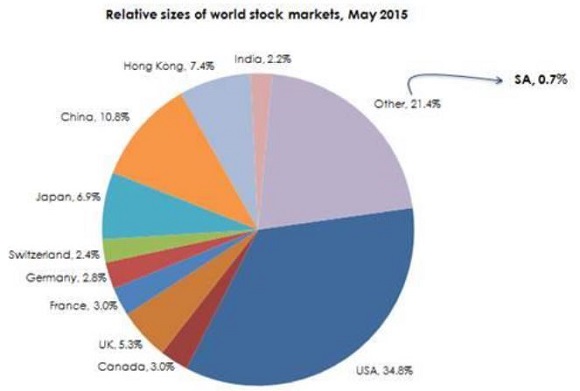

The South African stock market makes up just less than 1% of global stock market capitalisation. Considering the small size of this market and that local shares are relatively expensive, Marriott is of the view that investors who adopt a global investment mindset will be well served from both a diversification and valuation perspective. The chart below illustrates the relative size of stock markets around the world:

Based on current first world market valuations it is possible to invest in some of the largest and most recognizable companies in the world on yields higher than South African equities. These attractive yields afford investors the opportunity to diversify internationally and improve the overall quality of their portfolios.

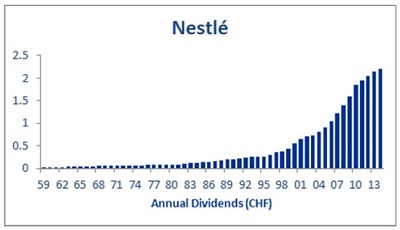

Nestlé is a prime example of a quality company investors can choose to invest in when adopting a global mindset. With over 2000 brands and 10 000 products, Nestlé sells over 1 billion products daily, making it one of the most prolific companies in the world. Its success can be attributed to the nature of its brands, which allows the company to form part of the day-to-day lives of people around the world. Nescafe, for example, is the world’s best-selling coffee brand and accounts for 44 percent of the instant coffee market. Consumers around the world drink on average 5500 cups of Nescafe every second of every day. Other examples of Nestlé brands include Maggi 2 Minute Noodles and Kit Kat - 5.2 billion packets of Maggi Noodles are sold every year and 650 Kit Kat fingers are consumed every second of the day.

Dividend Track Record:

Although there are many quality South African listed companies, none can equate to Nestlé in terms of size, track record, global diversification and number of brands. A global investment mindset opens the door to these qaulity companies.

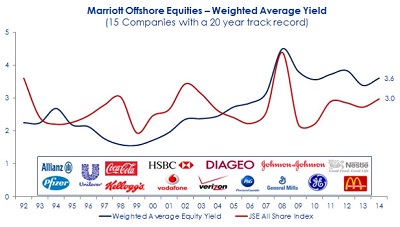

With the JSE All Share Index currently at historic highs (above 50000) and dividend yields below historic averages, we feel investors looking for good returns from the South African market could be disappointed in the years ahead. The South African equity market in general offers little value; however our outlook for certain global equities is very positive.

The chart below highlights the yield differential between a selection of quality international companies and the yield of the South African All Share Index.

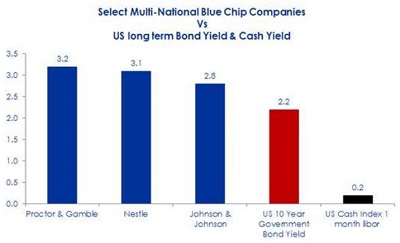

Equities are also attractively priced relative to bonds and cash in first world markets. Very low interest rates means investors can currently receive more income from equities than government bonds and money in the bank. This is a very rare occurance as equities, unlike bonds, also provide investors with income growth which ultimately translates into capital growth.

The chart below compares the yields of Proctor & Gamble, Nestlé and Johnson & Johnson to the yields of the US 10 year Government Bond and US cash.

In summary, the case for investing in first world equities remains compelling as the yields of high quality multi-national companies are currently higher than first world bonds as well as South African equities. A global mindset will allow investors to take advantage of this opportunity and improve the overall quality of their portfolios.

Investors can access these companies in three ways:

1. Marriott’s rand-denominated feeder funds offering access to Marriott’s International Funds

2. Marriott International Funds (Ireland Domiciled)

a. First World Equity Fund (£)

b. International Income Growth Fund ($)

c. International Real Estate Fund ($)

Minimum investment - £ 15,000

3. The International Investment Portfolio - personlised share portfolio

Investors may select one of three managed discretionary share portfolios or create a non-discretionary portfolio. One of the major benefits of an offshore share portfolio is its tax efficiency. As the investor is the beneficial owner of the shares they will not be taxed twice on the dividends they receive.

Minimum investment - £ 50,000

This release has been issued on behalf of Marriott, the Income Specialists

For more information, please contact:

Lisa-Marie Lloyd, Marriott Marketing:

031 765 0766 – direct

031 765 0700 – switchboard

Distributed by: Shirley Williams Communications

Shirley Williams: 031 564 7700 or 083 303 1663

Gillian Findlay: 082 330 1477

About Marriott, the Income Specialists

Marriott aims to reduce financial anxiety of retired investors by offering Solutions for Retirement, using an Income Focused Investment Style which produces reliable and consistent monthly income.