Marriott’s advice to investors: Invest your money where you spend your money

Global markets have been volatile since the beginning of 2015 due to question marks over the likely timing of the first US interest rate hike and various geo-political issues. While these factors could continue to cause price volatility in the short-term, how they ultimately unfold will have a minimal impact on the performance of Marriott’s portfolios in the long-term.

This is because Marriott follows a rigorous filtering process when choosing companies in which to invest—a process that selects only the companies likely to deliver reliable and consistent dividend growth, and therefore predictable capital growth, in the years ahead. “During periods of volatility it is important to remember that over the long-term dividend growth results in capital appreciation,” said Duggan Matthews, Investment Professional at Marriott Asset Management. Consequently, Marriott’s investment philosophy is to ensure reliable and consistent dividend growth from every equity in their portfolios; locally and offshore. According to Matthews, this means that of the thirty-two companies which feature in Marriott’s portfolios, twenty are listed offshore. “This is where we find better valuations and more secure dividend growth prospects,” he said.

Marriott’s mantra for investors is to invest their money where they spend their money. Marriott themselves follow this philosophy: when they decide on companies in which to invest, they look whether the companies fulfil a basic need, whether the companies own strong brands, whether or not the companies have pricing power and exposure to growing markets, and whether they are globally diversified.

“Fundamental to predictable dividend growth is a product offering which forms part of our day-to-day lives,” explained Matthews. Future dividend prospects are then largely unaffected by changing economic conditions, technologies and trends which are notably difficult to predict. Nestlé is a good example of a company fulfilling a basic need. Nestlé owns the world’s best-selling coffee brand and accounts for 44 percent of the instant coffee market. Consumers around the world drink on average 5500 cups of Nescafe every second of every day. Other examples of Nestlé brands include Maggi 2 Minute Noodles and Kit Kat. Over five billion packets of Maggi Noodles are sold every year and 650 Kit Kat fingers are consumed every second of the day.

Why do customers choose one product over another? More often than not it comes down to trust. Accordingly, Marriott invests in companies with strong brands. For example, Colgate-Palmolive controls around 45% of the toothpaste market, while Coca-Cola controls approximately 50% of the carbonated soft drink market. “Customer loyalty created by strong brands keeps competitors at bay, ensuring reliable dividends,” said Matthews.

Another factor Marriott takes into account in the ability of a company to pass on rising input costs to consumers without sacrificing turnover and margins. This is important to dividend growth. Companies with brand dominance in consumer everyday activities tend to enjoy pricing power due to the consistent demand for their products. Spar’s operating profit margin, for example, has been stable since 2004, despite the price of food in South Africa doubling over this period.

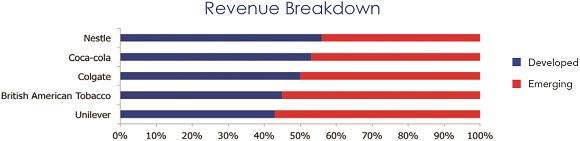

Growing markets are as important for dividend growth. Many of Marriott’s international equities have meaningful exposure to emerging economies as illustrated in the chart below:

Driven by economic growth in emerging markets, approximately one quarter of a million people join the middle class every day, according to The Boston Consulting Group. This bodes extremely well for the dividend and capital growth prospects of the companies which own the world’s most sought-after consumer brands.

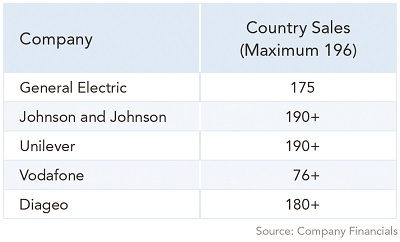

Marriott also only invests in well-diversified companies. “The future prospects of these companies are not tied to the fortunes of one particular economy or dependent on the success of one particular product,” said Matthews. “This makes dividend growth more reliable”. Johnson and Johnson, for example, sells health care products in virtually every country in the world, ranging from baby powder and plasters to medical devices and prescription medication.

The table below illustrates the global nature of Marriott’s international equities:

Making the right investment decisions today requires having a reasonable expectation of how investments are likely to perform in the future. Unfortunately, nothing will stop investor emotions, such as fear and greed, from causing short-term share price volatility. In the long term however investing in companies which fit these five criteria is more likely to produce predictable dividend and capital growth.

This release has been issued on behalf of Marriott Asset Management

For more information, please contact:

Marriott

Lisa-Marie Lloyd, Marriott Marketing:

031 765 0766 – direct

031 765 0700 – switchboard

Shirley Williams Communications

Shirley Williams: 031 564 7700 or 083 303 1663

Gillian Findlay: 082 330 1477

About Marriott, the Income Specialists

Marriott aims to reduce financial anxiety of retired investors by offering Solutions for Retirement, using an Income Focused Investment Style which produces reliable and consistent monthly income.