Residential Research - Global Residential Cities Index

Results for Q1 2016

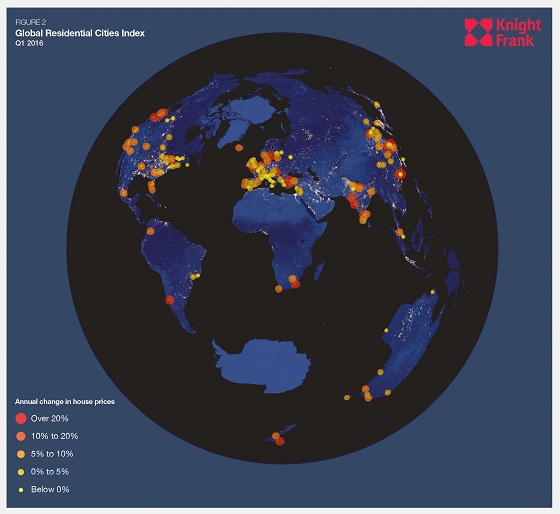

- The Global Residential Cities Index increased by 4.5% in the year to March 2016

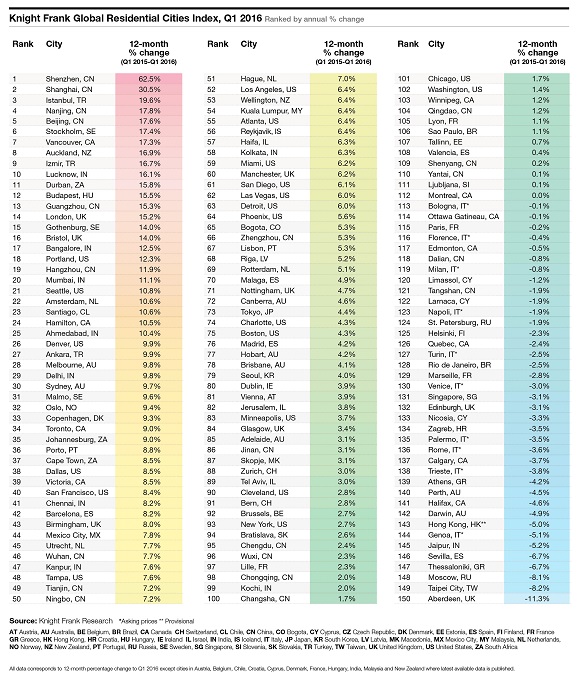

- Chinese cities now account for four of the world’s top five performing cities

- Shenzhen leads the rankings prices rose on average by 63% over the 12-months to March 2016

- Scandinavia is home to five of Europe’s top ten performing city housing markets

- Prior to the UK’s Brexit decision, London was the UK’s strongestperforming city and Europe’s third strongest

KATE EVERETT-ALLEN

International Residential Research

Follow Kate at @keverettkf

CHINESE CITIES DRIVE GLOBALRESIDENTIAL PRICE INDEX HIGHER

Seventy-four percentage points now separate the world’s strongest and weakest-performing mainstream city housing markets. Kate Everett-Allen examines the latest set of results.

The Global Residential Cities Index, which is based on official house price data published by either National Statistic Offices or Central Banks, for 150 cities across the world, increased by 4.5% in the year to March 2016.

Seventy-four per cent of the cities tracked by the index saw house prices rise in the year to March 2016. The gap between the strongest and weakest performing housing market has expanded from 55 percentage points last quarter to 74.

The widening gap can, to a large extent, be attributed to the phenomenal rate of growth recorded in the Chinese city of Shenzhen. This rapidly-expanding technology hub, located within 11 miles of Hong Kong, saw annual price growth jump from 48% last quarter to 63% in the year to March 2016.

Chinese cities now account for four of the top five performing cities but new measures introduced in March in some Tier 1 cities such as Shenzhen and Shanghai are likely to lead to more muted growth during the remainder of 2016. The new rules range from higher down payments for first and second homes as well as longer residency requirements for non-locals wishing to purchase.

Scandinavia is emerging as a key centre of growth. The cities of Stockholm, Gothenburg, Malmo, Oslo and Copenhagen all recorded annual price growth of between 9% and 17% in the year to March. Low levels of new supply, high demand and cheap finance are fuelling price growth across the region.

Vancouver continues to be North America’s stellar performer, prices ended the year to March 17% higher. A proposal by Mayor Robertson to tax empty homes is under discussion as a means to increase rental supply and address the lack of affordable homes in the city.

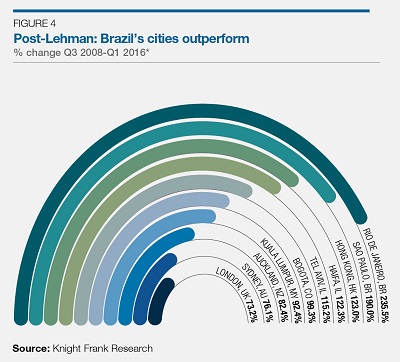

Despite the recent slowdown in their economies and fall in sales, analysis post-Lehman highlights the extent to which cities in emerging markets such as Rio de Janeiro, Sao Paulo and Bogota still stand out, having recorded price growth of 236%, 190% and 99% respectively in the eight years since 2008. (figure 4).

Life post-Brexit

The data under analysis covers the period to Q1 2016 but looking to the future, all eyes will now be on the UK’s decision to leave the EU and the impact it has on property markets, not just in the UK but globally.

Future domestic demand will be linked to the direction of interest rates, changes to mortgage rules and employment growth whilst currency shifts will be the key determinant of cross-border investment.

Source: Knight Frank Research *Asking prices ** Provisional

AT Austria, AU Australia, BE Belgium, BR Brazil, CA Canada CH Switzerland, CL Chile, CN China, CO Bogota, CY Cyprus, CZ Czech Republic, DK Denmark, EE Estonia, ES Spain, FI Finland, FR France GR Greece, HK Hong Kong, HR Croatia, HU Hungary, IE Ireland IL Israel, IN India, IS Iceland, IT Italy, JP Japan, KR South Korea, LV Latvia, MK Macedonia, MX Mexico City, MY Malaysia, NL Netherlands, NO Norway, NZ New Zealand, PT Portugal, RU Russia, SE Sweden, SG Singapore, SI Slovenia, SK Slovakia, TR Turkey, TW Taiwan, UK United Kingdom, US United States, ZA South Africa

All data corresponds to 12-month percentage change to Q1 2016 except cities in Austria, Belgium, Chile, Croatia, Cyprus, Denmark, France, Hungary, India, Malaysia and New Zealand where latest available data is published.

RESIDENTIAL RESEARCH

Liam Bailey - Global Head of Research

+44 20 7861 5133

Kate Everett-Allen - International Residential Research

+44 20 7167 2497

PRESS OFFICE

Astrid Etchells - International PR Manager

+44 20 7861 1182

Important Notice

© Knight Frank LLP 2016 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.