Residential Research - Prime Global Rental Index

PRIME GLOBAL RENTAL INDEX ENTERS POSITIVE TERRITORY

Knight Frank’s Prime Global Rental Index increased by 0.5% in the year to June 2016. Taimur Khan analyses the latest results.

Results for Q2 2016

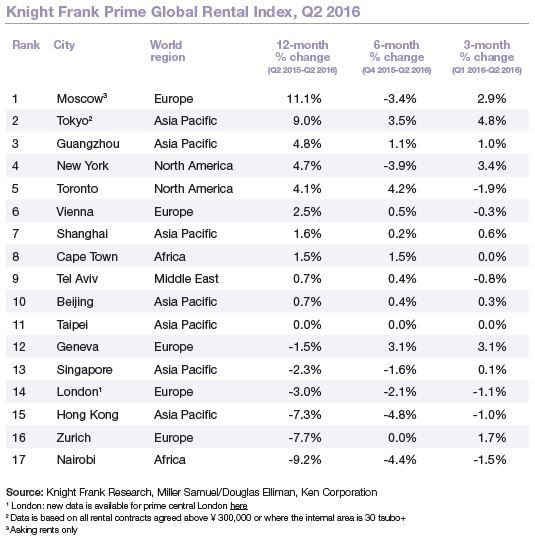

- Our prime global rental index rose by 0.5% in the year to June 2016, the first time it has recorded positive annual growth in the last year

- Moscow leads the rankings with prime rents rising by 11.1% on an annual basis

- North America is the strongestperforming world region for the third consecutive quarter, with prime rents rising by 4.4% per annum on average

- Of the 17 cities tracked by the index, ten saw prime rents rise in the 12 months to June 2016

- Nairobi occupies the bottom ranking with rents slipping by 9.2% year-on-year

Knight Frank’s Prime Global Rental Index, which tracks the change in luxury residential rents across 17 cities globally, recorded annual growth of 0.5% in the year to June 2016. The number of cities where rental growth has increased rose from seven in the previous quarter to ten this quarter.

Moscow holds the top spot, with prime rents rising by 11.1% year-on-year. Sizable infrastructure investments in the city, combined with a marked slowdown in the contraction of the national economy and substantial gains in oil price over the last quarter have underpinned rental growth.

Nairobi continues to be the weakestperforming market with prime rents falling by 9.2% annually. Since Q3 2011 Nairobi has recorded annual prime rental growth of 9.7% on average, the market is now looking to rebalance.

The slowdown in the prime central London rental market continues with rents falling by 3.0% in the 12 months to June 2016 with higher stock levels and uncertainty in financial markets contributing to the fall. The data for London largely covers the period leading up to the UK’s EU referendum; our latest Prime Central London Index can be found here.

The gap between the top and bottom ranking cities has risen considerably. The strongest performing city (Moscow) and the weakest performing city (Nairobi) are separated by 20.3%. A year earlier the comparable figure was 15.1%.

North America, for the third consecutive quarter, registered the strongest increase with prime rents rising by 4.4% in the year to Q2 2016. Over the same time period, Africa recorded the weakest performance with prime rents falling by 3.9% on average.

Whilst uncertainty caused by Brexit and the US presidential election still lingers, we are starting to see a more positive global economic landscape develop. Sustained and positive economic data from the US, growth in emerging markets led by easier access to credit markets and increased demand from China for commodities suggest a positive outlook for the remainder of 2016. For prime rental markets these factors are likely to stimulate demand from corporate tenants.

DATA DIGEST

The Knight Frank Prime Global Rental Index is an important resource for investors and developers looking to monitor and compare the performance of prime residential rents across key global cities. Prime property corresponds to the top 5% of the housing market in each city. The change in prime residential rents is measured in local currency. The index is compiled on a quarterly basis using data from Knight Frank’s network of global offices and research teams.

Courtesy: Knight Frank

RESIDENTIAL RESEARCH

Liam Bailey - Global Head of Research

+44 20 7861 5133

[email protected]

Taimur Khan - Senior Research Analyst

+44 20 7861 1436

[email protected]

PRESS OFFICE

Astrid Etchells

+44 20 7861 1182

[email protected]

Important Notice

© Knight Frank LLP 2016 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.