Residential Research - London Development Hotspots

Residential Development Opportunity Areas 2018

Key highlights:

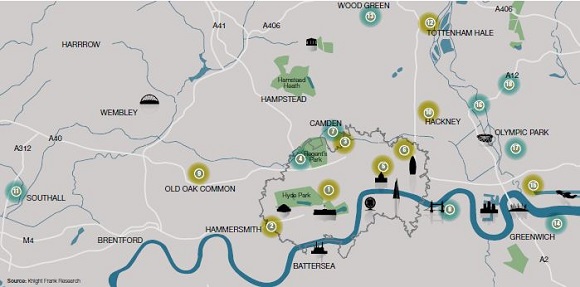

- The new development hotspots identified feature a wider geographical spread than previous reports.

- In terms of values, the majority are localities where new-build developments are priced at sub-£800psf and most are also outside zone 1. This emphasises the changing landscape for development in London, with a greater focus on affordability.

- Royal Docks within the Lower Lea Valley area was identified as a Hotspot in 2015. It remains a development opportunity area, alongside three other localities within the wider Leamouth area – Hackney Wick, West Ham and Leyton.

- Major urban regeneration areas such as Earl’s Court and King’s Cross are included in the list, however ‘pre-regeneration’ areas like Lisson Grove and Old Oak Common are also identified.

Areas to Watch

Knight Frank’s Hotspots report identifies areas across London where there is the potential for residential development values to outperform the wider market.

This is the third Hotspots report, and while some previously identified locations still make the list, other, new, localities have been identified for 2018. The methodology for identifying these areas, which is set out in detail on page 8, includes examining upcoming transport infrastructure upgrades, large-scale regeneration or place-making and identifying areas in which there is a price differential compared to neighbourhoods close by.

It is worth noting that the prices we are examining in the hotspots are quite distinct from our wider market forecasts, which include all types of housing. Instead, we are looking at localised areas, comparing an assumed present-day value for new-build property to the prices that may be reached by the end of 2021. We have assumed that best-in-class developments will be delivered in each location.

The development landscape in London has changed in the two years since Knight Frank’s previous report. These changes have been triggered by political, economic and policy events – not least the vote to leave the EU and additional stamp duty. Planing policies in the capital have also evolved following the election of a new Mayor in 2016.

Average prices across the London market fell on an annual basis in London for the first time in eight years in 2017, according to Nationwide. However, this headline figure masks a multi-speed market with some boroughs still seeing price growth.

As seen in previous reports, transport infrastructure upgrades, regeneration and realm change are all factors which can feed into new-build and second-hand market pricing.

The new development hotspots identified feature a wider geographical spread than previous reports. In terms of values, the majority are localities where new-build developments are priced at sub-£800psf and most are also outside zone 1. This emphasises the changing landscape for development in London, with a greater focus on affordability.

The timeframe over which we are forecasting, 2018-2021, encompasses the opening of the Queen Elizabeth Line (Crossrail). In many cases the opening of the high-speed rail link from the end of next year has already been priced into sales values in and around station hubs, although for stations where large-scale development is still in the pipeline, pricing could reflect this in the future.

The changing dynamics of the London market in the last two years have also had an impact on the performance of some of our 2015 hotspots. Some of these areas have not seen the growth in pricing over the timeframe forecast, but are still seen as areas of opportunity. Other hotspots identified in 2015 are no longer included in the list, in many cases because they have reached their outperformance potential, and are likely now to move more in line with the market.

"The financial demands of undertaking large urban renewal projects are material and it is essential that it is recognised by all parties that pump priming prices is a necessity, not only to ensure financial viability but also to encourage developers, through profit, to commit to these projects. Given the current conditions, particular attention and emphasis is needed to ensure the built environment is of the highest quality. In particular we believe many schemes need to over stretch the upfront cashflow to deliver exemplar product set into a high quality realm. Where successful, the rewards will follow. However, it is important that these are not seen just as super profit, instead they should be considered in the context of each scheme’s long-term heritage and environmental contribution." JAMES KEEGAN - RESIDENTIAL DEVELOPMENT CONSULTANCY

HOTSPOT FACTORS

Place-making

Investment in improvements to public spaces and upgrading existing town centres is helping to drive demand across the capital, as well as opening up previously under-used land for both residential and commercial development use. As the need for new housing continues to rise, the creation of new neighbourhoods will become increasingly important.

Transport

Changes in transport infrastructure stimulate and open up parts of a city, attract investment, create additional demand for housing and can bring new energy to markets in and around transport hubs. The opening of the Elizabeth Line this year will cut journey times across the capital, opening up new markets and improving connections in existing ones. Proposed and future transport upgrades, such as HS2 and Crossrail 2 are likely to further drive development in and around station hubs.

Regeneration

Regeneration can lead to a wholesale change of identity for an area. The Mayor of London is working alongside local authorities and developers to bing physical improvements to London. Many large-scale schemes planned or currently under development in London will also see the provision of new shops, restaurants and cafés alongside residential property. Where this is happening, we see potential for outperformance relative to the wider market.

Price Differential

Changing dynamics in the residential market in London are reflected in the 2018 development hotspots. Demand has increased in the outer boroughs and this is driving strong residential price growth, yet average values across the area remain lower than London’s average. As investment in infrastructure and regeneration continues, these areas have the potential to help deliver a wider range of new homes.

Development

Net supply of new housing London rose to 39,560 in 2016/17, compared to the 66,000 new homes a year needed in the capital. This imbalance looks set to continue. There are a number of areas of the capital where large-scale development projects are currently taking place, many of which won’t be fully completed for a number of years. As demand continues to outstrip supply, these new neighbourhoods are expected to benefit and have the potential to outperform the wider market. However, the changing policy landscape could weigh on new supply in some areas.

"Achieving critical mass is a key assumption in a number of our hotspots, as this delivers the perception of change, which in turn drives value. There is undisputed broad demand for new homes in these areas, however, there remain tangible threats to delivery in the form of uncertain macroeconomic conditions, Government cooling measures and restrictive planning policy direction. The key to successful delivery will lie in creative and thoughtful solutions to these threats, to meet the demands of both policy makers and developers alike." CHARLIE HART - HEAD OF CITY AND EAST DEVELOPMENT

HOTSPOTS 2018

FOCUS ON NEW HOTSPOTS

SOUTHALL/HAYES

CURRENT PRICING: £600 PSF

2021 FORECAST: £750 PSF

Southall will see a significant reduction in journey times once Crossrail trains are in operation in 2019. As of yet, there has been very little development activity in the area, but there are a number of large projects in the pipeline that will enhance the area’s amenity offering, as well as delivering new homes. There is currently one development under construction within a 15-minute walk of the Crossrail station, with a further eight developments in the pipeline with permissions for 4,489 private units. The level of development and regeneration set to take place around the station indicates that Southall has the potential for price outperformance relative to the local area.

WOOD GREEN

CURRENT PRICING: £650 PSF

2021 FORECAST: £800 PSF

The local authority, Haringey, has earmarked over £3 billion for development in Wood Green, which would include 60,000 sq ft of new employment space and the potential creation of 4,000 jobs. The development would also include 7,700 new homes and a new town centre with shops, restaurants and cafés. The local authority points to the opening of the Green Rooms on Station Road in June 2016, a social enterprise that offers affordable accommodation aimed at people working in the arts, as a catalyst for regeneration in the area. Wood Green is a 15-minute journey to King’s Cross on the Piccadilly line. It has also been shortlisted as a potential station along the Crossrail 2 line – this is important to the plans for the area, but regeneration will continue whether or not the route gets the green light.

CAMDEN TOWN

CURRENT PRICING: £1,100 PSF

2021 FORECAST: £1,500 PSF

Camden Town is receiving a multimillion pound investment from the Mayor’s Regeneration Fund, plus £1m from Camden Council, Camden Town Unlimited and Transport for London, to improve public space and invest in local business. Over 150,000 people a week visit Camden’s markets, shops, restaurants and music venues. Part of the redevelopment includes the Camden Lock Village development, which will comprise eight buildings, a new canalside market, cafes and restaurants, a cinema, 195 residential units, a food quarter and commercial space. Nearby Euston Station is also set for improvements, with six new high-speed platforms being built to support the opening of the first branch of the HS2 route in 2026, and a further five highspeed platforms planned for the opening of HS2 phase 2, which runs from London to Leeds and Manchester. Technology giant Google’s plan to open a new head office down the road in King’s Cross underpins the status of the wider area as a business, as well as a residential, hub. If granted, the plans for an interchange for both Crossrail 2 and HS2 in Euston will enhance this standing.

LISSON GROVE

CURRENT PRICING: £1,400 PSF

2021 FORECAST: £1,850 PSF

Lisson Grove has lagged behind neighbouring areas of Regents Park, St John’s Wood and Marylebone in terms of capital values over the past decade. Its relative affordability compared with prime central London makes Lisson Grove well placed to benefit as buyers widen their search areas. Westminster council launched a 20-year, £1.2 billion regeneration blueprint for the Church Street ward, in which Lisson Grove is located, earlier this year. As part of the plan, the local authority has pledged to favour art and antiques tenants over other uses when shops come up for lease, with the aim to turn it into a market to rival Portobello Road. This comprehensive regeneration and improvement to the local housing stock will enhance values.

CANADA WATER

CURRENT PRICING: £900 PSF

2021 FORECAST: £1,350 PSF

The Canada Water Masterplan, led by British Land, is a £2 billion project to create a major new town centre within Southwark. This will comprise 3,500 new homes, offices, shops, restaurants and public spaces, including a threeacre park, a cultural and leisure centre and a new campus for King’s College London. Work is already underway on a mixed-use, residential-led development by Notting Hill Housing and Sellar Developments on an eight-acre site in the heart of Canada Water. Transport connectivity in the area is already of a high standard, with the Jubilee line offering journey times of 2 minutes and 12 minutes to Canary Wharf and the West End respectively. It is also a key interchange on the Overground network. The new masterplan, coupled with the existing transport links, will serve to generate a greater rate of growth than in the wider area.

LOWER LEA VALLEY

Royal Docks within the Lower Lea Valley area was identified as a hotspot in 2015. It remains a development opportunity area, alongside three other localities within the wider Leamouth area:

WEST HAM

CURRENT PRICING: £700 PSF

2021 FORECAST: £950 PSF

West Ham station was recently rezoned by TfL from Zone 3 to Zone 2/3, a move which saves commuters travelling into central London several hundred pounds a year in ticket fares. Transport options from this area also include the Jubilee, District, Hammersmith & City, Overground and DLR lines, along with Crossrail running from Stratford from 2019, making it one of the best-connected transport hubs in East London. Despite the strong price growth seen in this area over the last three years, average prices still offer a relative discount when compared to neighbouring localities. Looking along the Jubilee line, average re-sale prices in West Ham are the lowest compared to all other stations in zones 1 and 2.

LEYTON

CURRENT PRICING: £675 PSF

2021 FORECAST: £800 PSF

Leyton sits on the edge of an area that has undergone considerable change, with the development of Westfield, Stratford International Station and the Queen Elizabeth Olympic Park all nearby. The local council has identified Leyton as a priority growth area within Waltham Forest, with plans to create a new community to the west and south of the town centre. As part of this, there are proposals to build new homes, primary schools, health and public facilities, as well as making improvements to road and rail access, resulting in better connections into the Queen Elizabeth Olympic Park. The current timeframe is for this to be complete by 2022.

HACKNEY WICK

CURRENT PRICING: £700PSF

2021 FORECAST: £850 PSF

Situated on the edge of the Olympic Park and just four miles north of the City of London, Hackney Wick is benefitting from public sector-led regeneration overseen by the London Legacy Development Corporation. Plans are in place to create a new neighbourhood with thousands of new homes, live-work dwellings, workshops and small business premises, further enhancing the offer for creative industries which have sprung up in the canal-side area. In addition, the overground train station, which connects the area with Canary Wharf and the West End is undergoing a £25 million facelift to help improve accessibility. We expect this ongoing regeneration will have a positive impact on pricing in the coming years.

EXISTING HOTSPOTS, AND AREAS TO WATCH

As noted earlier in the report, some areas in our hotspots are included for the second or even third time, as there is still anticipation of some future outperformance. A few of these areas have not seen the full level of growth previously predicted between 2015 and 2018 given the changing dynamics of the market, but may now see this growth over a longer time-frame.

In the case of Earl’s Court, the scale of the forecast uplift is dependent on the commencement of development work. In recent years, the estimated average value in Earl’s Court for best-in-class development has risen to £1,650 psf, but this could reach £2,100 by 2021, as long as comprehensive development starts on the Earl’s Court Masterplan.

Other previous hotspots do not make the 2017 list as, having registered some levels of growth, they are now expected to move more in line with the market.

However, there will still be some opportunities for outperformance, for example in Acton, with the opening of Crossrail, and the Canary Wharf Estate as the new residential district becomes established. Other areas to watch are Whitechapel and the Olympic Park. The level of growth seen in the last two years are behind those forecast in 2015, but there is likely some additional level of price outperformance to come. Euston is another area to watch. Development plans have been pushed back several times but, once agreement is reached, there will be a complete overhaul of the station, which will be felt in the surrounding areas.

MARKET UPDATE

The development market in London has not only been affected by the tax and policy changes which have had an impact on the whole housing market, but also specific factors such as rising development costs, changing land values and the availability of development funding, especially for smaller developers.

Residential development land prices in prime central London are now 13% lower than two years ago, although price declines have largely abated this year.

Average land prices in the wider London market, based on a small basket of sites around the capital, are largely flat on the year. The increased focus on affordability, and the drive towards the provision of more Affordable Housing, which is to be welcomed, has led to new policy around planning, with the Mayor of London pledging to speed up the process for those who offer at least 35% Affordable Housing when submitting schemes for planning approval. This change has led to some developers having to reassess their development economics and has, in some cases, slowed down the process of development.

Certainly the level of development across the capital has dipped since 2015, with 24,201 new private housing starts on schemes of more than 20 units in 2016, down from nearly 34,000 in 2015, according to data from Molior.

Financing is also a factor at play here, with rising costs for materials and, for some developers, funding. In other cases, accessing funding is becoming more challenging. The weakness of sterling is proving a draw for overseas developers however.

There is still a strong need for housing in the capital as employment continues to rise. In such an environment however, all the fundamentals need to be aligned before market outperformance can be expected. This report highlights some locations where a variety of factors have the potential to deliver abovemarket performance, but this assumes best-in-class development

METHODOLOGY:

In our analysis, we had regard for demographic and economic forecasts – but the critical elements in our assessment have been the factors which are likely to lead to the dynamics of a particular market area meaningfully changing over time. We have looked closely at new and proposed transport infrastructure, the spread of gentrification as well as current and potential pricing. Critically we have also concentrated on areas where there is a real opportunity, through either refurbishment or redevelopment, for residential developers to enter the market and undertake significant schemes over the next five years.

Working with our London Residential Development land and new homes teams we have determined a final short-list of ‘hotspots’ across London where we believe there is:

- (a) scope for development activity,

- (b) an underlying market undergoing improvements due to infrastructure investment or sociodemographic shifts and

- (c) potential for price outperformance over the next few years.

Courtesy: Knight Frank

RESIDENTIAL RESEARCH

Gráinne Gilmore - Head of UK Residential Research

+44 20 7861 5102

Oliver Knight - Associate

+44 20 7861 5134

RESIDENTIAL DEVELOPMENT

Justin Gaze - Joint Head of Residential Development

+44 20 7861 5407

Ian Marris - Joint Head of Residential Development

+44 20 7861 5404

Rupert Dawes - Head of New Home Sales

+44 20 7861 5445

James Mannix - Head of Residential Capital Markets

+44 20 7861 5412

Charlie Hart - Head of City and East Development

+44 20 7718 5222

Abigail Heyworth - Partner, Residential Development

+44 20 7861 5414

James Keegan - Partner, Residential Development

+44 20 7861 5481

Knight Frank Residential Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs.

Important Notice

© Knight Frank LLP 2018 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.