Residential Research - Prime Global Cities Index

Results for Q2 2018

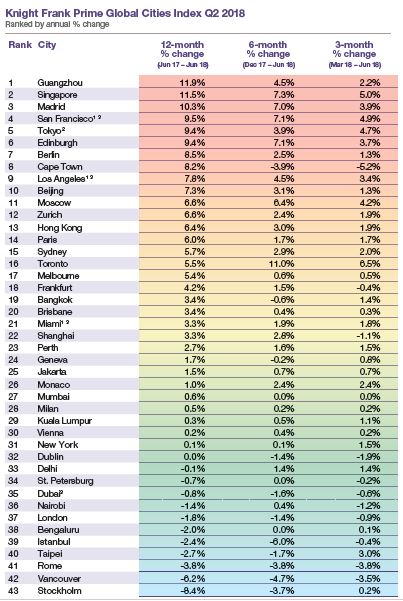

- Guangzhou (11.9%) leads the annual rankings down from 16.1% last quarter

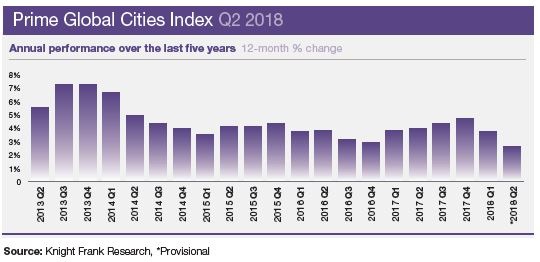

- The index recorded its weakest rate of annual growth since 2012 (2.6%)

- The number of cities registering doubledigit annual price growth declined from seven last quarter to three

- Luxury prices in Singapore have rebounded strongly but recent stamp duty changes may impact

- Cape Town and Dublin are seeing prime price growth soften but for very different reasons

PRIME PRICES DRIFT LOWER ACROSS GLOBAL CITIES

Our Prime Global Cities Index climbed 2.6% in the year to June 2018, its weakest annual rate of growth since the final quarter of 2012.

The decline in the overall index’s performance is not due to a rising number of cities registering an annual decline. Instead, the weaker growth is due to the top performing cities rising more slowly. Last quarter seven cities registered double-digit annual price growth, this quarter only three – Guangzhou (11.9%), Singapore (11.5%) and Madrid (10.3%).

The gap between the strongest and weakest performing city has shrunk from 33 to 20 percentage points in the last quarter.

The introduction of new, and the strengthening of existing, property market regulations, along with the rising cost of finance and a degree of political uncertainty is resulting in more moderate price growth at the luxury end of the world’s top residential markets.

Guangzhou leads the rankings with Beijing (7.3%) and Shanghai (3.3%) in 10th and 22nd place respectively. The recent decision by Chinese authorities to scale back a major housing subsidy programme is expected to dent sales volumes in second and third tier cities but prime prices in first tier cities are expected to see steady growth in the coming year.

Singapore (11.5%) has accelerated up the annual rankings and now sits in second place. High land bids by developers has translated into higher new-build values. In an attempt to curb price inflation, the authorities announced further increases to the Additional Buyer Stamp Duty (ABSD) in July, this includes higher rates for foreign buyers (20%) and for developers (30%) as well as tighter lending rules.

Hong Kong has also introduced a new cooling measure – a new vacancy tax. Under the new rules, developers will incur a penalty, 200% of the annual rental value, if new apartments are left unsold and empty for six months or more.

In the US, San Francisco (9.5%) and Los Angeles (7.8%) are the frontrunners. The US economy is firing on all cylinders and housing demand has been boosted by a buoyant labour market.

Cape Town and Dublin stand out as two prime markets where luxury price growth has softened in the last six months but for very different reasons.

The rate of annual growth in Cape Town has halved in the last six months from 19.9% to 8.2%. The citywide drought and the uncertainty over the process of land expropriation without compensation has weakened sales activity. However, six weeks of solid rainfall and new land guidance from the Government has mitigated this concern and sales volumes are strengthening again.

By contrast in Dublin (0%), tighter lending rules, rising luxury supply and a reduction in sterling-denominated buyers is leading to more moderate price appreciation.

Source: All data comes from Knight Frank’s global network with the exception of Tokyo (Ken Corporation); New York (StreetEasy); Los Angeles, Miami and San Francisco (S&P CoreLogic Case-Shiller); Berlin and Frankfurt (ImmobilienScout 24); Stockholm (Svensk Maklarstatistik); Toronto (Real Estate Board of Toronto); Vancouver (Vancouver Real Estate Board); Zurich and Geneva (Wüest Partner); and Dubai (Property Monitor).

Notes: Data for New York relates to Manhattan; Data for Frankfurt is to Q1 2018. Data for New York is to May 2018 and data for Los Angeles, Miami, and San Francisco is to April 2018. The data for Berlin relates to those properties in the 95th quintile which are located in the central area of Berlin. ¹ Based on top-tier of mainstream market in metro area. ² Based on all contracts above Yen100m. 3 Provisional.

Courtesy: Knight Frank

RESIDENTIAL RESEARCH

Liam Bailey, Global Head of Research

+44 20 7861 5133

Kate Everett-Allen, International Residential Research

+44 207 167 2497

PRESS OFFICE

Astrid Recaldin

+44 20 7861 1182

Important Notice

© Knight Frank LLP 2018 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.