Residential Research - Global House Price Index results for Q2 2018

Results for Q2 2018

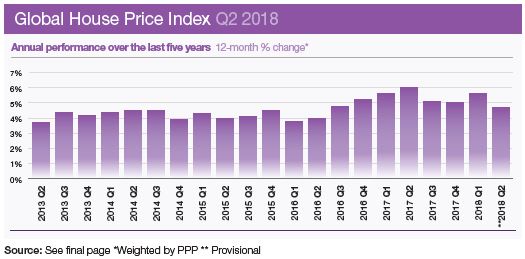

- The Knight Frank Global House Price Index increased by 4.7% in the year to June 2018

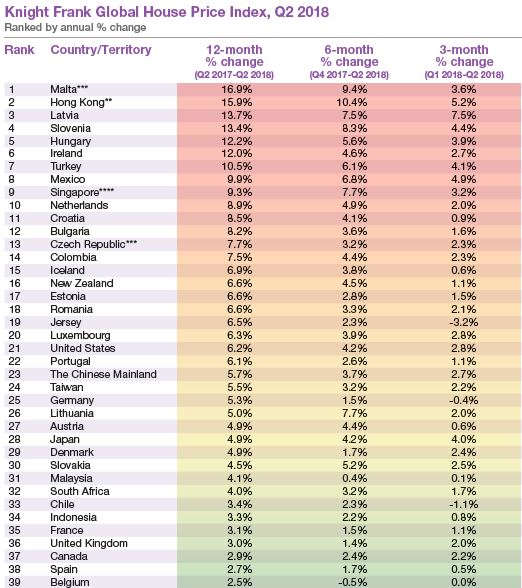

- Only seven of the 57 countries tracked registered falling prices over the 12 months to June 2018

- Malta (17%) leads the index for the first time

- Central and Eastern European countries are performing strongly

- All eyes are on Hong Kong (16%), Singapore (9%) and New Zealand (7%) where new property regulations have been introduced in the last three months

MALTA BUCKS TREND OF MODERATE HOUSE PRICE GROWTH

The number of countries experiencing annual house price growth is on the rise even as the average rate of growth moderates.

The Mediterranean island of Malta has moved ahead of Hong Kong this quarter to take the lead in our Global House Price rankings. According to data from the Central Bank of Malta prices increased 17% year-on-year. Supply constraints, combined with a robust economy (6.6% GDP growth in 2017) and a buoyant technology industry is pushing up demand.

Only seven countries and territories (12% of those monitored) registered a decline in prices in annual terms and no market has recorded a double-digit decline in house prices over the last six quarters. Five years ago, 30% of countries were recording a drop in house prices, and ten years ago, in the wake of the financial crisis, the figure was as high as 70%.

Yet despite this improving scenario, at 4.7% the index has recorded its slowest rate of annual growth since Q3 2016. Our analysis confirms that whilst fewer countries and territories are seeing a decline in house prices, where prices are rising, they are rising at a more moderate pace. The rising cost of finance, an uncertain political and economic climate and currency instability in some markets is likely to be tempering demand.

Hong Kong acts a case in point. A city which has led our rankings for price growth on ten occasions since 2009, is expected to cool in the coming months as a result of rising interest rates.

Along with Singapore and New Zealand, Hong Kong has also seen new property market regulations introduced in the last three months (Figure 3).

Central and Eastern Europe is emerging as a region of strong growth. Latvia, Slovenia and Hungary all saw prices accelerate by between 12% and 14% over the year to June 2018 and the region as a whole registered average growth of 8% compared with 5.1% for the rest of Europe (Figure 4). Strengthening economies, improving employment and the wider availability of low rate mortgages are behind the region’s strong performance.

Turkey’s travails mean that although prices are rising at an annual rate of 11%, according to the latest data from the Central Bank of the Republic of Turkey, when inflation of 16%+ is factored in, prices in real terms are now falling.

With the 10-year anniversary of the collapse of Lehman Brothers approaching on 15 September, a brief look at house prices over this period (where data permits) shows mainstream house prices in 12 of the 57 countries are still below their Q3 2008 level, including those in Spain, Ireland, Italy, Greece and Russia.

Courtesy: Knight Frank

DATA DIGEST

The Knight Frank Global House Price Index established in 2006 allows investors and developers to monitor and compare the performance of mainstream residential markets around the world. The index is compiled on a quarterly basis using official government statistics or central bank data where available. The index’s overall performance is weighted by GDP on a Purchasing Power Parity basis and the latest quarter’s data is provisional pending the release of all the territories’ results.

Sources: Knight Frank Research; Macrobond, Bank for International Settlements; Eurostat; Australian Bureau of Statistics; OeNB; Statbel; FIPE; Bulgarian National Statistical Institute; Teranet in alliance with National Bank of Canada; Chilean Chamber of Construction; China National Bureau of Statistics (NBS); DANE; Croatian Bureau of Statistics; Central Bank of Cyprus; Czech Statistics Office; Statistics Denmark; Statistics Estonia; Statistics Finland; INSEE; Federal Statistical Office of Germany; Bank of Greece; Hong Kong Rating & Valuation Department; Hungarian Central Statistical Office; Statistics Iceland; India National Housing Bank; Bank of Indonesia; Irish Department of Environment, Heritage and Local Government; Israel Central Bureau of Statistics; Italian National Institute of Statistics; Japan’s Ministry of Land, Infrastructure, Transport and Tourism; States of Jersey Statistics Unit; Central Statistics Latvia; Lithuania State Enterprise Centre of Registers; STATEC; Malaysian Valuation & Property Services Department; Central Bank of Malta; Mexican Federal Mortgage Company (SHF Sociedad Hipotecaria Federal); Central Bank of Morocco; Statistics Netherlands; Quotable Value LTD and Reserve Bank of New Zealand; Statistics Norway; Central Reserve Bank of Peru; Polish Central Statistical Office (GUS); Portuguese National Statistics Institute (INE); Romanian Statstics Office; Rosstat; Saudi Arabian Central Department of Statistics & Information (CDSI); Singapore Urban Redevelopment Authority (URA); National Bank of Slovakia; Slovenian Statistical Office; First National Bank; Government of South Korea; Spanish Ministry of Development; Statistics Sweden; Swiss National Bank/Wuest & Partner; Taiwan Ministry of the Interior; Central Bank of the Republic of Turkey (TCMB); Blagovest; HM Land Registry; S&P Case Shiller

RESIDENTIAL RESEARCH

Liam Bailey - Global Head of Research

+44 20 7861 5133

Kate Everett-Allen - International Residential Research

+44 20 7167 2497

PRESS OFFICE

Astrid Recaldin

+44 20 7861 1182

Important Notice

© Knight Frank LLP 2018 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.