United Kingdom - UK set for historic decline in housing delivery, says Knight Frank

KEY POINTS

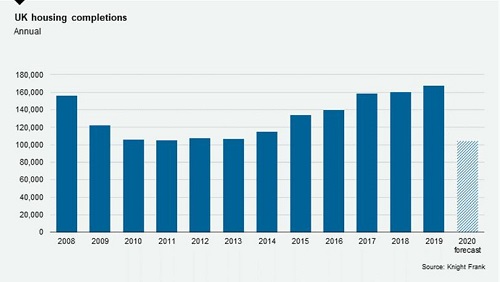

- Total delivery of privately built new homes will drop by 35% in 2020

- Private housing delivery in 2020 will be lower than in the years following the global financial crisis

- Nationally, housing delivery will stand at around 104,000 this year, a drop of 56,000

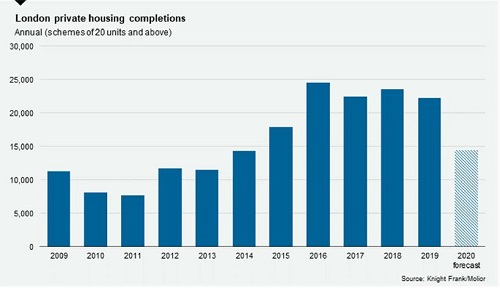

- In London, Knight Frank expects 8,000 fewer homes to be built – with private housing delivery the lowest since 2014

According to analysis conducted by global property consultancy Knight Frank, Covid-19 and the knock-on impact of the government lockdown, will result in 56,000 fewer homes being delivered this year, a 35% drop.

As housebuilders begin to plan their return to work strategies, Knight Frank’s latest analysis reveals the dramatic impact Covid-19 has already had on the UK’s construction sector.

The firm’s study into private housebuilding has highlighted that national housing delivery will stand at around 104,000 this year. In London, new housing is set to hit its lowest point since 2014, with 8,000 fewer homes forecasted to be built compared to the five year private housing delivery average, which saw 14,405 completions. Whilst housebuilding by private developers makes up just one portion of overall housing delivery, the drop will prove a significant setback to the Mayor of London’s yearly target of 55,000 new homes.

Knight Frank’s review of pipeline data suggests that (as of 17th April) work had been suspended on residential schemes capable of delivering nearly 250,000 new homes across the UK. Whilst some of these will be on sites at various stages of completion, and on projects due to be delivered over a multi-year timeframe, it is clear that the building hiatus will have a sizable impact on the number of homes built in 2020 and beyond.

Justin Gaze, Head of Residential Development Land at Knight Frank, said: “Faced with supply chain challenges and a national material shortage, developers are under increasing pressure to adhere to tight social distancing controls, while also coping with an ever dwindling availability of skilled workers. This has cast a dark cloud over the capacity for housebuilders to deliver at scale and speed.”

Last week marked the start of some housebuilders setting out their strategies for a phased return to site construction and operating, albeit with strict social distancing protocols. In most cases this will mean a slow and steady return to activity. Knight Frank noted that; “this is not simply a case of flicking a switch back on.”

The government-imposed lockdown has been extended for at least another three weeks when it will be reviewed again on 7 May. Official guidance advises that construction sites can stay open, as long as social distancing protocols are adhered to. Many housebuilders, however, have opted to shutter sites through the lockdown to protect workers, as well as a result of supply-chain difficulties.

Gaze continues: “Now is the time for the government to intervene and support the private sector in getting building again. There needs to be a pragmatic approach. Extending Help to Buy and relaxing planning regulations to give developers greater flexibility on Section 106 and Community Infrastructure Levy (CIL) payments would be greatly welcomed. Introducing a Stamp Duty holiday and streamlining the conveyancing process would also be a major stimulus. These measures would no doubt act as a real driver for the wider UK economy; helping to create jobs, new housing and ultimately receipts for the treasury via increased liquidation in the market.”

Indeed, even under the assumption that housebuilders recommence construction in early to mid-May, getting back up to speed will take time. There are a myriad of issues related to the supply chain, for example, with question marks over the availability of building materials, as well as delivery, distribution and labour.

Oliver Knight, Research Associate at Knight Frank, said: “More intangibly, consumer sentiment will also impact recovery, and the fact remains that housebuilders will only build what they can sell. In the short-term, this will mean giving priority to restarting and completing sites where there are existing customer orders.

“Of course, the key question which will determine the impact is 'how long'. If Covid-19 disruption is short-lived that could mean the UK can get back on track relatively quickly. However, the longer the disruption the greater the pressure on the market and longer the recovery.”

APPENDIX - New private housing delivery

The government-imposed lockdown has been extended for at least another three weeks, taking us to 7th May. Official guidance advises that construction sites can stay open, as long as social distancing protocols are adhered to.

Many housebuilders, however, have opted to shutter sites through the lockdown to protect workers and as a result of supply-chain difficulties.

Our analysis of pipeline data suggests that (as of 17th April) work had been suspended on residential schemes capable of delivering nearly 250,000 new homes across the UK.

Whilst some of these will be on sites at various stages of completion, and on projects due to be delivered over a multi-year timeframe, it is clear that the building hiatus will have a sizable impact on the number of homes built in 2020 and beyond.

Gradually, we are starting to see firms setting out their strategies for a phased return to site construction and operating, albeit with strict social distancing protocols. In most cases this will mean a managed slow and steady return to activity. This is not simply a case of flicking a switch back on.

Indeed, even under the assumption that housebuilders recommence construction in early to mid-May, getting back up to speed will take time. There are a myriad of issues related to the supply chain, for example, with question marks over the availability of building materials, as well as delivery, distribution and labour.

More intangibly, consumer sentiment will also impact recovery, and the fact remains that housebuilders will only build what they can sell. In the short-term, this will mean giving priority to restarting and completing sites where there are existing customer orders.

Taking this into account, alongside our own conversations with some of the major housebuilders in recent weeks, our expectation is that private housing delivery across the UK in 2020 will be around 35% less than what it would otherwise have been.

To this end, if we take the Office for Budget Responsibility’s (OBR) pre-Covid forecast that 160,901 private housing completions would take place this year, this means housing delivery will stand at around 104,500 in 2020, a drop of 56,000 new homes.

Commenting on the figures, Justin Gaze, Head of Residential Development Land at Knight Frank, said: “Faced with supply chain challenges and a national material shortage, developers are under increasing pressure to adhere to tight distancing controls and an ever dwindling availability of skilled workers. This has cast a dark cloud over the capacity for housebuilders to deliver at scale and speed.

“Now is the time for the government to intervene and support the private sector in getting building again. There needs to be a pragmatic approach. Extending Help to Buy and relaxing planning regulations to give developers greater flexibility on Section 106 and Community Infrastructure Levy (CIL) payments would be greatly welcomed. Introducing a Stamp Duty holiday and streamlining the conveyancing process would also be a major stimulus. These measures would no doubt act as a real driver for the wider UK economy; helping to create jobs, new housing and ultimately receipts for the treasury via increased liquidation in the market.”

In London, if we assume housing delivery in 2020 would have been in line with the five year average of 22,162 private housing completions, according to Molior (which includes sites of 20 units and above), this would result in 14,405 homes being built this year, a reduction of nearly 8,000. The lowest since 2014 and significantly below the Mayor’s target of delivering 55,000 new homes.

These figures refer solely to private housebuilding and therefore do not take into account activity from housing associations, or local authorities. It will also not include other additions to net housing supply such as conversions.

As we have noted previously, government support could be key to a faster recovery period once the lockdown has passed.

An extension of time to implement existing and pending planning permissions, given current barriers to developers starting on sites, would be a start, and one that has the backing of the HBF, the trade body for the home building industry. There is also a precedent with the government having granted similar temporary powers between 2009 and 2012 following the financial crisis.

Greater flexibility should also be encouraged with regards to the payment of planning obligations, such as section 106 and Community Infrastructure Levy (CIL) payments. Such outlays are generally paid up-front and a move to allow practical staggering or staged payments would be welcome. Local authorities are now exploring just this issue, with recommendations to delay CIL payments to support developers during the pandemic.

Of course, the key question which will determine the impact is 'how long'. If Covid-19 disruption is short-lived that could mean the UK can get back on track relatively quickly. However, the longer the disruption the greater the pressure on the market and longer the recovery.

Courtesy: Knight Frank

For further information, please contact:

Freddy Fontannaz – Head of Residential PR – [email protected]

About Knight Frank

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank has more than 19,000 people operating from 512 offices across 60 territories. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit knightfrank.com.

DISCLAIMER

Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. © Knight Frank LLP 2020. Terms of use: This report is published for general information only and not to be relied upon in any way. All information is for personal use only and should not be used in any part for commercial third party use. By continuing to access the report, it is recognised that a licence is granted only to use the reports and all content therein in this way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without prior written approval from Knight Frank LLP. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.