UK Property - High-value country house market is strongest UK performer

New Knight Frank data shows the Country House market finished 2020 with the annual price change being the best performance for more than six years.

- Overall, the index recorded an increase of 1.7% in the three months to December. This took the annual price change during 2020 to 4%, which was the best performance for more than six years.

- The number of offers accepted finished the year 35% ahead of the five-year average.

- Properties valued at more than £5m saw the strongest growth in the three months to December, rising 5.1%. This pushed the annual rate of growth to 7.9% in that price bracket.

- Exchanges had also exceeded last year’s total by 3% by mid-December. Around 30% of the offers accepted are still to exchange, which means transactional activity should remain high into 2021

Country House price growth finishes 2020 on a high

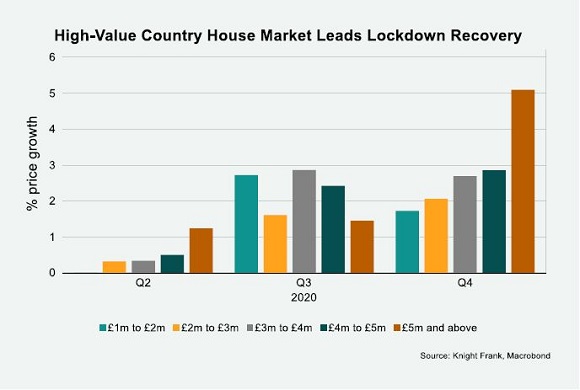

The Country House market finished the year as it began after the market reopened in May, with high-value properties proving to be the strongest performer during the fourth quarter.

High-value country house market is strongest UK performer

Prices edged up over the last three months as demand for prime properties with outdoor space has grown

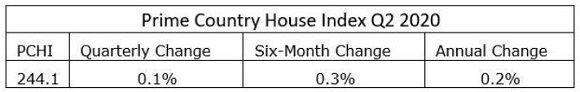

Country houses valued at £5m-plus saw the strongest price growth of any property type in the UK in the three months to June, due to interest in country living and the greater ability of buyers in higher-price brackets to transact.

An increase of 1.2% was recorded in the second quarter of 2020 despite the fact property markets were closed between late March and mid-May as a result of the global pandemic. The overall Country House index was flat, as increased demand for outdoor space and greenery offset the impact of Covid-19.

“Buyers at the top end of the market have been willing and able to move quickly to secure their desired homes as lockdown restrictions have eased,” said Chris Druce, senior research analyst at Knight Frank. “The relative scarcity of homes available at this price point can spark competitive bidding, which has put a degree of upwards price pressure at this end of the market.”

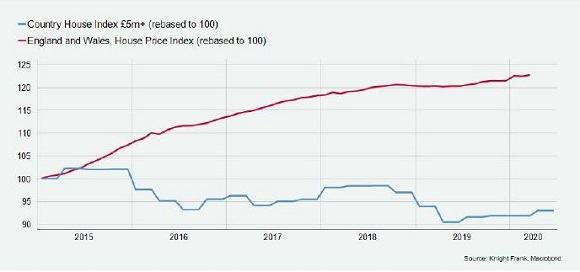

Prices have declined across UK markets during lockdown, which mirrors what has happened in prime London markets. However, higher-value properties outside of the capital have performed better due to the combination of growing demand for outdoor space and buyers who are in a financial position to act more swiftly.

Price growth for higher-value properties has also been weaker than the wider market in recent years due to a series of tax changes, leaving greater scope for future rises. While prices in England and Wales grew 22% in the five years to March 2020, the Knight Frank £5m-plus index fell 8.1%.

An analysis of offers accepted outside of London between 13 May and 24 June shows that the £5m to £10m price bracket has come back more strongly than the rest of the market. The number of offers accepted was 182% higher than the five-year average. This compared to 64% for all price brackets.

Furthermore, the number of new prospective buyers for £5 million-plus properties in country markets was 137% higher than the five-year average over the same period. Across all price brackets, the rise was 52%

“People are sensing an opportunity now,” said Edward Rook, partner in Knight Frank’s Country Department. “In the previous three or four years there have been consistent bumps in the road and the clear water people were looking for never came. We had that at last after the general election and then the lockdown came. People have simply decided it’s now or never.”

In a year dominated by the escape to the country trend, properties valued at more than £5m saw the strongest growth in the three months to December, rising 5.1%. This pushed the annual rate of growth to 7.9% in that price bracket.

Overall, the index recorded an increase of 1.7% in the three months to December. This took the annual price change during 2020 to 4%, which was the best performance for more than six years.

Despite the impact of an eight-week lockdown, the number of offers accepted finished the year 35% ahead of the five-year average.

Exchanges had also exceeded last year’s total by 3% by mid-December. Around 30% of the offers accepted are still to exchange, which means transactional activity should remain high into 2021.

Higher-value properties have performed strongly in 2020 due to the combination of growing demand for outdoor space and buyers being in a financial position to act more swiftly. The pandemic has also been a catalyst for buyers and sellers to bring plans forward. Price growth for higher-value properties has also been weaker than the wider market in recent years due to a series of tax changes, which provided greater scope for rises.

The second national lockdown in the autumn failed to halt the market’s momentum, with new prospective buyers registering with the country business up 42% versus the five-year average in November and, underlining how the market’s seasonality has been diminished this year, instructions for sale 22% ahead of the five-year average in November.

Seven of the ten most viewed locations were outside of London during the second national lockdown, underlining that demand for country living remains strong and suggesting that if the escape to the country trend begins to unwind as the roll-out of vaccines gather pace, it will only do so gradually.

Courtesy: Knight Frank

CONTACT FOR FURTHER INFORMATION:

Leona Mehra - Country PR Manager

Knight Frank

55 Baker Street

London

W1U 8AN

United Kingdom

T:+44 20 7167 2491

S:+44 20 7629 8171

M:+44 7970 155 151

knightfrank.com

Knight Frank Research Reports are available at knightfrank.com/research

Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. © Knight Frank LLP 2020. Terms of use: This report is published for general information only and not to be relied upon in any way. All information is for personal use only and should not be used in any part for commercial third party use. By continuing to access the report, it is recognised that a licence is granted only to use the reports and all content therein in this way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without prior written approval from Knight Frank LLP. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.