Global Wealth - Los Angeles Focus 2021

Residential sales in Los Angeles above US$10m soar despite the pandemic.

London, UK – Despite the pandemic, Los Angeles witnessed a significant increase in the number of residential sales above US$10m in 2020, up 26% compared to a year earlier, according to Knight Frank. One hundred and fifty-five properties at this level transacted in the market over the year, overshadowing the 123 registered in 2019.

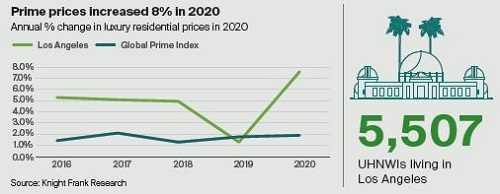

Despite the strong sales rates, the average sale price in LA dipped from US$20m to US$17m over the same period. However, prime price growth remains strong with the market experiencing an 8% increase in prime prices in 2020, making that the tenth consecutive year of price growth.

Knight Frank forecasts further prime price increases of 3% in 2021 due to a shortage of quality stock, a result of the post pandemic-induced surge in sales.

Kate Everett-Allen, partner, residential research at Knight Frank said: “A year from the start of the pandemic, signed contracts in Los Angeles are up 39% year-on-year, confirming the city as a key hub for buyers. Home to 5,507 ultra-high-net-worth individuals (UHNWIs), Los Angeles is the world’s third largest city wealth hub, and according to Knight Frank’s Wealth Report 2021, the sixth most popular city when it comes to where the wealthy want to live, work and invest.”

Further analysis of the post pandemic housing market, reveals that the reduction in mortgages rates saw UHNW buyers take advantage of the availability of cheap debt and leverage their assets, resulting in a decline of cash buyers. Cash buyers as a percentage of total sales in Los Angeles slumped from 41% in the second quarter of 2020 to 20% in the final quarter according to Knight Frank’s partners in the US, Douglas Elliman/Miller Samuel.

Looking ahead post-pandemic, the Los Angeles market seems set to continue its upward trajectory. Knight Frank confirms that the city is one of the most liquid real estate markets globally, second only to New York. As an innovative city, due to its quality of academic research, funding and entrepreneurship, it bodes well for post-pandemic resilience.

Los Angeles is set to enter a new phase of reinvention with wellness and sustainability at its core. It has an ambitious plan to reinvent the 51-mile stretch of the LA River. The brainchild of Frank Gehry, the plan has identified 20 sites in which to invest in green space, from platform parks to green bridges and bike paths, the project will improve the city’s air quality over the next decade. In addition, as the city gears up for the 2028 Olympics, there will be a host of transport and infrastructure improvements.

Jason Mansfield, associate, United States and Canada at Knight Frank said: “Los Angeles is largely a domestic market; however, its popularity is also found amongst investors from Asia, the UK, France, Sweden, Denmark, Norway and the Middle East. The city has more millionaires than Tokyo or Hong Kong, with neighbourhoods such as Bel Air, Beverly Hills, Holmby Hills and Brentwood having some of the city’s largest wealth densities.”

Los Angeles Focus 2021

What does The Wealth Report 2021 tells us about who lives, works and invests in the city and how do perspectives on property investment in the US differ to those globally?

Knight Frank’s annual flagship publication, The Wealth Report 2021, is packed with data and insight on how wealth is influencing property markets globally. A new series of focus reports delves deeper into the data to explore what the findings mean for some of our key cities.

In this edition, we assess the importance of Los Angeles to the world’s wealthy, how its prime market is faring against the backdrop of a global pandemic and draw on the findings of the attitudes survey which sits at the heart of The Wealth Report to gauge where US ultra-high-net-worth individuals (UHNWIs) think future opportunities lie.

10 things you need to know about the Los Angeles market

1. Los Angeles is the world’s third largest city wealth hub

Los Angeles is home to 5,507 UHNWIs, the third largest concentration of any city globally. The global capital for entertainment and media also has strong finance, technology and education sectors. The city has more millionaires than Hong Kong SAR and Singapore with neighbourhoods such as Bel Air, Beverly Hills, Holmby Hills and Brentwood having some of the city’s highest wealth densities.

2. For UHNWIs, Los Angeles is the sixth most important city globally

Knight Frank’s City Wealth Index uncovers those cities where the wealthy want to live, work and do business. In sixth place overall, Los Angeles ranks highly in the wealth and lifestyle categories. Accessible from over 179 locations via LAX Airport, with 43 five-star hotels*, 26 Michelin-starred restaurants and an average of 292 days of sunshine each year the city ticks numerous boxes for the world’s wealthy.

3. Prime prices increased 8% in 2020

Los Angeles has recorded 10 consecutive years of price growth according to Knight Frank’s Prime International Residential Index (PIRI 100) with luxury prices rising 7.6% in 2020. Single family homes with large outdoor space and mountain or ocean views generated the highest premiums. We forecast prime prices will increase 3% in 2021 as the pandemic-induced surge in sales eases slightly due to a shortage of quality stock.

4. Signed contracts up 39% in March 2021 year-on-year

After a ‘stay-at-home’ order was issued in California on 19 March 2020, the housing market halted but measures eased in May and by July signed contracts were up 47% month-on-month as buyers reassessed their lifestyles and sought more space. A year on from the start of the pandemic and signed contracts are up 39% overall for single-family homes and condos.

5. Super prime sales up 26% in 2020

Some 155 properties worth over US$10 million were sold in Los Angeles in 2020, overshadowing the 123 registered in 2019. Despite the strong sales rates, the average sale price dipped from US$20 million to US$17 million. Neighbouring Orange County witnessed a similar trend. Los Angeles’s ultra prime market (US$25 million+) known for its strong international bias was hampered by the global travel ban yet still saw 16 sales agreed with an average sale price of US$35 million.

6. A shortage of supply is the city’s key constraint

Los Angeles’s key challenge remains a lack of stock, particularlycondominiums, which has been heightened further by the pandemicinduced slowdown in construction, this will protect prices in the short to medium-term. New listings of single-family homes fell 47% in the year to March 2021 whilst condo listings increased 4% over the same period.

7. Record low mortgage rates see cash buyers diminish

Los Angeles’s share of cash buyers is usually above the US average but the reduction in mortgage rates saw UHNWI buyers opt to take advantage of the availability of cheap debt and leverage their asset. According to Miller Samuel cash buyers as a percentage of total sales in Los Angeles slumped from 41% in the second quarter of 2020 to 20% in the final quarter, mortgage rates shifted from 3.4% to 2.9% over the same period.

8. An innovative city bodes well for post-pandemic resilience

Los Angeles ranks highly in Knight Frank’s innovation-led cities index which confirms that the city is one of the most liquid real estate markets globally, second only to New York and it scores highly for innovation due to its quality of academic research, funding and entrepreneurship. Silicon Beach, home to 500 start ups, technology now accounts for around 20% of all employment.

9. Sustainable living boosted by LA River Plan

Cities are set to enter a new phase of reinvention as a result of the pandemic with wellness and sustainability at their core, as highlighted in The Wealth Report 2021. Los Angeles has a head start with an ambitious plan to reinvent the 51-mile stretch of the LA River which runs from Canago Park to Long Beach. The brainchild of Frank Gehry, the plan has identified 20 sites in which to invest in green space, from platform parks to green bridges and bike paths the project will improve the city’s air quality over the next decade.

10. LA28: The Olympics as a driver of investment

In 2028, Los Angeles will be the third city in the world to host the games three times, along with Paris and London. Although City Hall has committed to no new stadiums for the games, there will be a host of transport and infrastructure improvements, from the US$5 billion Automated People Mover (APM) a 2.25-mile train linking LAX with light rail lines, to road and rail upgrades as well as the addition of some 8,000 new hotel rooms.

We like questions, if you’ve got one about our research, or would like some property advice, we would love to hear from you.

Courtesy: Knight Frank

Head of US Team

Stacey Watson

+44 20 7861 1062

Sales

Jason Mansfield

+44 20 7861 1199

Georgina Atkinson

+65 6429 3598

Research

Kate Everett-Allen

+44 20 167 2497

Press

Astrid Recaldin

+44 20 7861 1182

Important notice

© 2021. All rights reserved. Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.