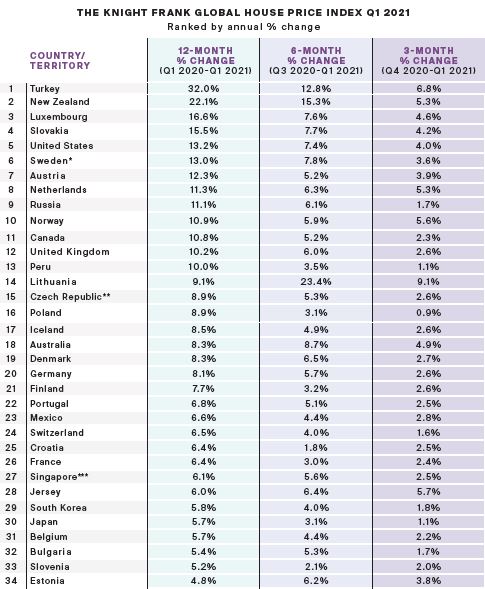

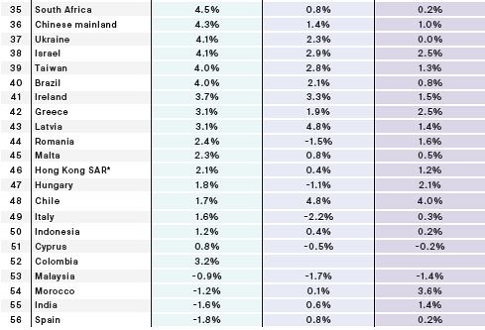

International Property - Global House Price Index, Q1 2021

- Turkey is the country with the highest rate of annual price growth in the year to Q1 2021

- 7.3% average change in prices across 56 countries and territories

- 13 countries/territories registered double-digit annual price growth in the year to Q1 2021

- United States experienced the country’s highest rate of annual price growth since December 2005 with an increase of 13.2%

- New Zealand saw house prices increase by 22% in the year to Q1 2021

Globally, house prices are rising at their fastest rate since Q4 2006. Knight Frank’s Global House Price Index, a means of benchmarking average prices across 56 countries and territories, increased 7.3% in the year to March 2021.

Turkey leads the rankings for annual price growth for the fifth consecutive quarter, but strip out inflation and real prices are rising at around 16% per annum.

Aside from Turkey the top ten is largely comprised of developed nations, including New Zealand (22%), the US (13%), Sweden (13%), Austria (12%) and Canada (11%).

With twelve countries recording double-digit price growth in the year to Q1 2021 it is no surprise that talk of postpandemic housing bubbles is increasing but authorities are already starting to take action.

Cooling measures return

Since January 2021, authorities in China, New Zealand, and Ireland have intervened with a range of measures from tighter lending rules to higher stamp duties for multiple purchases. Canada is also looking closely at a national vacancy tax and China is mulling over a national property tax.

With governments taking action and fiscal stimulus measures set to end later this year in a number of markets, buyer sentiment is likely to be less exuberant, plus, the threat of new variants and stop/start vaccine roll-outs have the potential to exert further downward pressure on price growth.

It’s not a global boom

Behind the headlines, however, there are several large economies where strong price growth remains elusive and where sales have yet to gain traction – Italy (1.6%), India (-1.6%) and Spain (-1.8%) all recorded lower price growth in Q1 2021 than a year earlier either due to stringent lockdowns, economic concerns or excess supply.

Sources: Knight Frank Research, Macrobond, Bank for International Settlements, Australia Property Monitor, National Bank of Austria (Oesterreichische Nationalbank), Statistics Belgium, Brazilian Foundation Institute of Economic Research (FIPE), Bulgarian National Statistical Institute, Teranet, National Bureau Statistics, Chilean Chamber of Construction, Colombian National Administrative Department of Statistics (DANE), National Bank of Croatia, Central Bank of Cyprus (CBC), Eurostat, Statistics Denmark, Statistics Estonia, Statistics Finland, French National Institute of Statistics & Economic Studies (INSEE), German Federal Statistical Office (Statistisches Bundesamt), Bank of Greece, Hong Kong Rating & Valuation Department, Statistics Iceland, Bank Indonesia, Irish Central Statistics Office (CSO), Israel Central Bureau of Statistics (CBS), Italian National Institute of Statistics (Istat), Japanese Ministry of Land, Infrastructure, Transport & Tourism, States of Jersey Statistics Unit, Lithuania State Enterprise Centre of Registers, Malaysian Valuation & Property Services Department, Central Bank of Malta, Mexican Federal Mortgage Company (SHF Sociedad Hipotecaria Federal), Statistics Netherlands (CBS), Real Estate Institute of New Zealand (REINZ), Statistics Norway, Central Reserve Bank of Peru (BCRP), Polish Central Statistical Office (GUS), Portuguese National Statistics Institute (INE), Russian Federal State Statistics Service (Rosstat), Singapore Urban Redevelopment Authority (URA), Central Bank of Slovakia, Slovenian Statistical Office, First National Bank, Statistics Korea (KoSIS), Spanish Ministry of Development, Statistics Sweden (SCB), Wuest & Partner, Taiwan Ministry of the Interior, Central Bank of the Republic of Turkey (TCMB), Blagovist Real Estate Agency of Ukraine, HM Land Registry, S&P Case Shiller

Courtesy: Knight Frank

Sales enquiries

Mark Harvey

+44 20 7861 5034

Research enquiries

Kate Everett-Allen

+44 20 7167 2497

Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. © Knight Frank LLP 2021. Terms of use: This report is published for general information only and not to be relied upon in any way. All information is for personal use only and should not be used in any part for commercial third party use. By continuing to access the report, it is recognised that a licence is granted only to use the reports and all content therein in this way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without prior written approval from Knight Frank LLP. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.