International Property - Global Residential Cities Index Q2 2021

KEY FINDINGS:

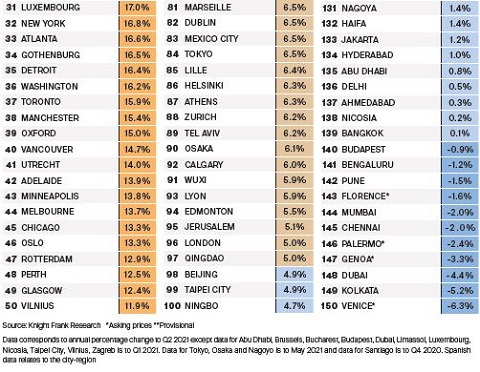

- Cities are now outpacing their national housing markets with prices rising by 9.8% on average in the year to Q2 2021, this compares to average of 9.2% across 55 countries and territories

- The Canadian city of Halifax leads the rankings with prices rising 30.8% in the year to Q2 2021

- Some 57 (38%) of the 150 cities tracked saw prices rise by 10% or more over the 12-month period

- Cities in the US, Canada, South Korea, New Zealand and Russia are amongst the strongest risers.

- The index confirms the growing divergence in the performance of US and Chinese mainland cities. On average prices across 15 US cities increased by 19.6% on an annual basis compared to 5.6% across 15 Chinese mainland cities

Cities are now outpacing their national housing markets with prices rising by 9.8% on average in the year to Q2 2021, this compares to an average of 9.2% across 55 countries and territories.

Predictions of ‘the death of the city’ now seem a distant memory.

The Canadian city of Halifax leads the index this quarter with price growth of 30.8% per annum.

Some 57 (38%) of the 150 cities tracked saw prices rise by 10% or more over the 12-month period. Two years ago, six Chinese mainland cities fell into this bracket, now only Guangzhou meets the criteria (11.4%)

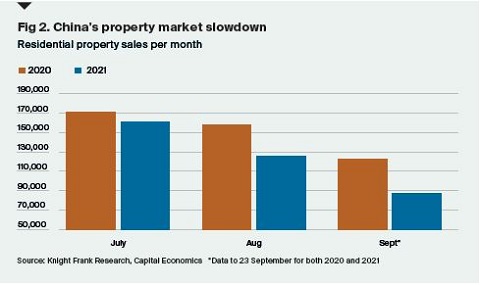

The Evergrande debacle has cast a shadow over once surging urban house prices in China. Although the gravity of the situation only emerged in Q3 there was evidence of a slowdown in price growth in Q2 (Fig 1) and sales activity has continued to slow in Q3 (Fig 2).

The scale of the divergence in US and Chinese mainland house prices is significant. We track 15 cities in both markets and on average those on the Chinese mainland saw prices rise by 5.6% over the 12-month period whilst US cities saw prices jump by 19.6%

Aside from US cities, other urban hotspots include those in Canada, South Korea, New Zealand and Russia.

In Moscow (28.8%) and St Petersburg (26.7%) a mortgage-subsidy program introduced in April 2020 by President

Putin to stimulate demand at the start of the pandemic, and to counter a slump in oil exports has led to strong sales activity pushing prices higher.

The question now is how long the boom, one largely confined to advanced economies, has to run. Our view is that demand will start to wane as pandemicamassed savings diminish and as monetary policy tightens. Norway is the first G10 economy to raise rates with New Zealand, the US and the UK set to follow in the short to medium term.

Other markets are taking a more radical and proactive step to curb price inflation. Mirroring New Zealand, Canada’s President Trudeau was re-elected on a promise to introduce a two-year countrywide ban on foreign buyers.

After 18 months of inertia, governments with heated housing markets are formulating their policy responses meaning we expect the index rankings to look very different in 12 or even six months’ time.

To stay up to date with the latest tax, policy or buyer restrictions sign up to my monthly global residential roundup.

Courtesy: Knight Frank

We like questions, if you've got one about our research, or would like some property advice, we would love to hear from you.

Research enquiries

Kate Everett-Allen

+44 20 7167 2497

PR Enquiries

Astrid Recaldin

+44 20 7861 1182

Knight Frank Research Reports are available at knightfrank.com/research

Knight Frank Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs. © Knight Frank LLP 2021. Terms of use: This report is published for general information only and not to be relied upon in any way. All information is for personal use only and should not be used in any part for commercial third party use. By continuing to access the report, it is recognised that a licence is granted only to use the reports and all content therein in this way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without prior written approval from Knight Frank LLP. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.