Knight Frank - Luxury Investment Index Q2 2021

Wine knocks recent winners Hermés handbags and whisky from top of the Knight Frank Luxury Investment Index with prices up 13%

London, UK – According to Knight Frank’s latest Luxury Investment Index (Q2 2021), wine has knocked Hermés handbags and whisky from their number one positions in the index in recent years, with prices of investment grade wine up 13% over 12 months to the end of June 2021.

Andrew Shirley, editor of Luxury Investment Index at Knight Frank said, “Two assets that have been at the helm of the Knight Frank Luxury Investment Index (KFLII) in recent years – rare bottles of scotch and Hermés handbags – have relinquished their places at the top of the index, recording negative 12-month growth. Wine is the front-runner in the 12 months to the end of June 2021 with prices rising 13% and 119% over a 10-year period.”

“Wine is doing really well, not going crazy but growing nicely. There are no signs of over exuberance,” explains Wine Owners’ Nick Martin who compiles the data for The Knight Frank Fine Wine Icons Index. “One market that has been doing well this year is Bordeaux. Burgundy, on the other hand, is taking a bit of a breather.” A recognition that some back vintages including 1996 and 2000 Bordeauxs, represent great value for money is helping attract more interest from collectors.

Looking at the classic car data from HAGI, which provides the data for the KFLII, it appears that the classic car market is in a good place with the value of a selection of the world’s rarest and most collectible vehicles rising 4% over the year to June 2021. Most interest is coming from experienced collectors and dealers who are prepared to pay top prices for the best cars.

Along with wine and cars, watches make the top-3 podium for this installment of the KFLII with Art Market Research’s basket of collectible timepieces showing annual growth of 5%.

Exploring the art market, it endured a bumpy period after the Covid-19 pandemic went global. The Art market Research All Art Index, which tracks the auction value of works produced by the world’s top 10,000 artists fell or remained flat for 11 consecutive months after peaking in April 2020 – a cumulative drop of 13%.

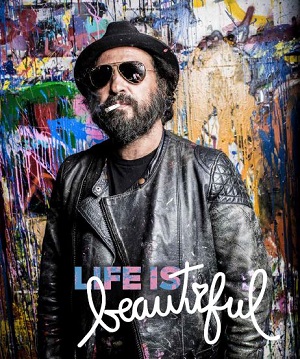

However, from April to July of this year much of that ground was recovered with the index recording growth of 10%. In May alone, US$2.9 billion of art was auctioned around the world. Illustrating the allure of the street art genre, one of the most expensive pieces to sell was In this Case, part of Jean-Michel Basquiat’s skull series, which went under the hammer with Christie’s New York for US$93 million.

To learn more about the allure of street art and an interview with renowned French street artist Thierry Guetta, better known as Mr. Brainwash, read Andrew Shirley’s interview with him in the recent edition of the Knight Frank Luxury Investment Index.

The Knight Frank Luxury Investment Index Q2 2021*

All data to June 2021 except coins to December 2020

Source: Compiled by Knight Frank Research using data from Art Market Research (art, coins, furniture, handbags, jewellery and watches), Fancy Color Research Foundation (coloured diamonds), HAGI (cars), Rare Whisky 101 and Wine Owners

Courtesy: Knight Frank

For further information, please contact: [email protected]

Notes to Editors

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank has more than 20,000 people operating from 488 offices across 57 territories. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit knightfrank.com